Budget Calculator

What is Budget Calculator?

Budget Calculator is a tool that helps individuals or businesses to track and manage their finances. It allows you to analyze your income and expenses, set budget goals, and keep track of your spending habits. With a budget calculator, you can gain a better understanding of your financial situation and make informed decisions about your money.

What are the types of Budget Calculator?

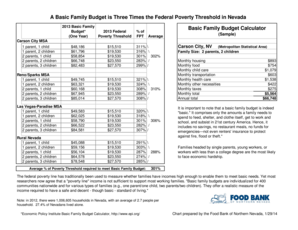

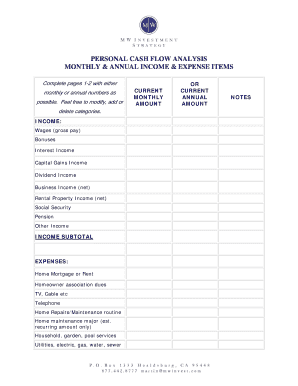

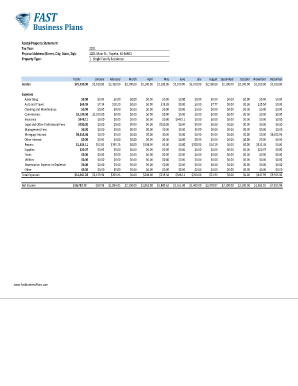

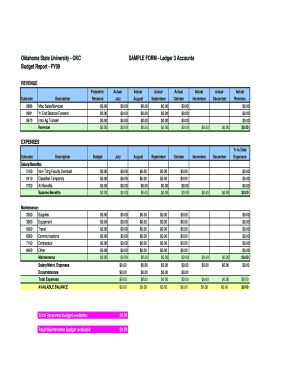

There are various types of budget calculators available to cater to different needs and preferences. Some common types include: 1. Personal Budget Calculator: This type of budget calculator is designed for individuals to manage their personal finances. 2. Business Budget Calculator: This type of budget calculator is tailored for businesses and helps in managing expenses, cash flow, and forecasting. 3. Household Budget Calculator: This budget calculator is specifically designed for managing household expenses, including bills, groceries, and other regular expenses. 4. Retirement Budget Calculator: This type of budget calculator focuses on planning for retirement and helps in estimating income, expenses, and savings needed for a comfortable retirement.

How to complete Budget Calculator

Completing a Budget Calculator is easy and can be done in a few simple steps. Here is a step-by-step guide to help you: 1. Gather your financial information: Start by collecting all the necessary information about your income, expenses, debts, and savings. 2. Calculate your income: Add up all your sources of income, including salary, bonuses, freelance work, or any other additional income. 3. List your expenses: Make a detailed list of all your expenses, including fixed costs like rent, utilities, and variable costs like groceries, entertainment, and transportation. 4. Categorize your expenses: Group your expenses into categories, such as housing, transportation, food, and entertainment. 5. Set budget goals: Determine how much you want to allocate to each category and set realistic budget goals. 6. Track your spending: Regularly update your budget calculator with your actual expenses to stay on track and make adjustments if needed. By following these steps, you can effectively complete a Budget Calculator and gain better control over your finances.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.