What is Budget Calculators?

Budget calculators are tools that help individuals or businesses calculate and manage their budgets. They provide a convenient way to track income, expenses, and savings, allowing users to gain a clear understanding of their financial situation. With a budget calculator, users can easily create a budget, set financial goals, and monitor their progress. These tools are especially useful for anyone looking to improve their financial health and make informed decisions about spending and saving.

What are the types of Budget Calculators?

There are various types of budget calculators available to cater to different needs and preferences. Some popular types include:

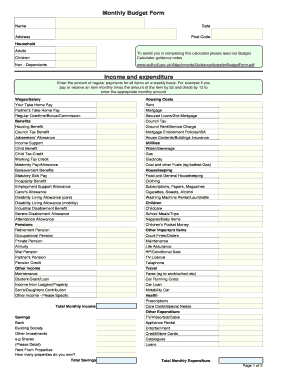

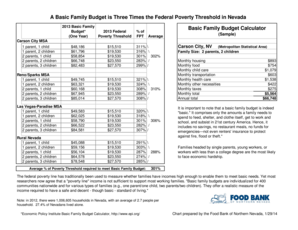

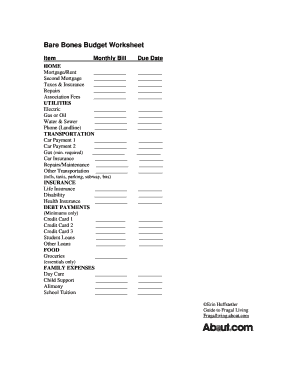

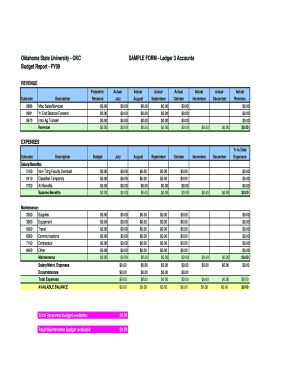

Monthly Budget Calculators: These calculators help individuals track their monthly income and expenses, allowing them to allocate funds to different categories and identify areas where they can save or reduce spending.

Debt Repayment Calculators: These calculators assist users in planning and managing their debt repayment strategies. They help determine the amount of money needed to pay off debts within a specific timeframe.

Savings Calculators: These calculators help individuals set savings goals and track their progress. They can calculate how much needs to be saved regularly to reach a specific savings target.

Retirement Calculators: These calculators help individuals plan for retirement by estimating the amount of savings needed and suggesting investment strategies to achieve those goals.

Investment Calculators: These calculators assist users in evaluating various investment options and estimating potential returns. They can provide insights into the growth of investments over time.

How to complete Budget Calculators

Completing budget calculators is an easy and straightforward process. Here are the steps to follow:

01

Gather all your financial information, including income, expenses, and any debts or savings.

02

Choose a budget calculator that suits your needs. Consider factors such as the type of budget you want to create and the features offered by the calculator.

03

Enter your financial information into the designated fields of the calculator. Provide accurate and up-to-date information for accurate results.

04

Review the calculated budget and analyze the breakdown of income, expenses, and savings. Identify areas where you can make adjustments or improvements.

05

Make necessary changes to your budget based on the insights provided by the calculator. Adjust spending habits, set savings goals, or create a debt repayment plan.

06

Regularly update and monitor your budget using the calculator. Adjustments may be needed as your financial situation changes.

07

Track your progress towards your financial goals and make adjustments to stay on track.

08

Consider using online tools or apps, such as pdfFiller, to easily create, edit, and share your budget calculator documents.

09

Utilize the unlimited fillable templates and powerful editing tools provided by pdfFiller to customize your budget calculator according to your specific needs.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.