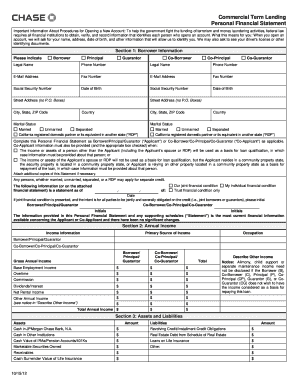

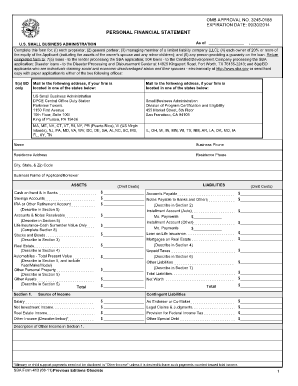

What is a Business Financial Statement Form?

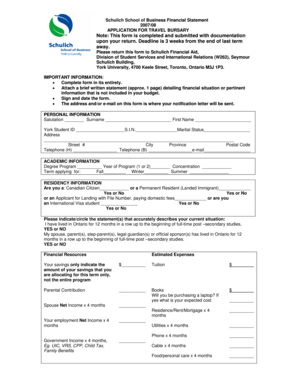

A Business Financial Statement Form is a document that provides a snapshot of a company's financial position. It includes important information such as income, expenses, assets, liabilities, and cash flow. This form is commonly used by businesses to present their financial information to banks, investors, and other stakeholders.

What are the types of Business Financial Statement Form?

There are several types of Business Financial Statement Forms that may be used depending on the specific needs of a business. The most common types include:

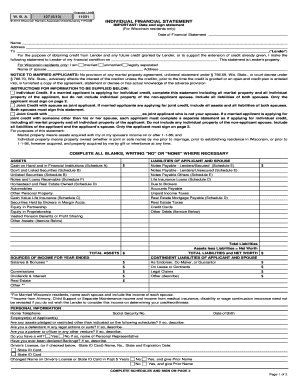

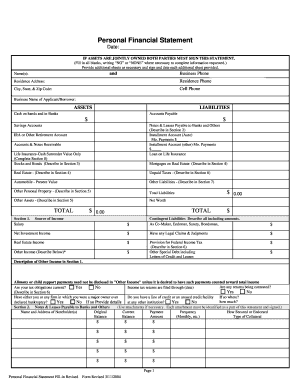

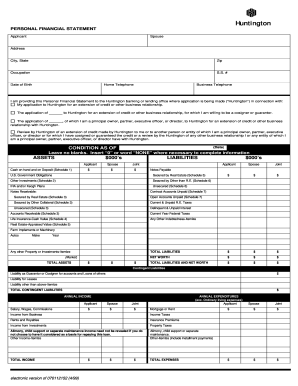

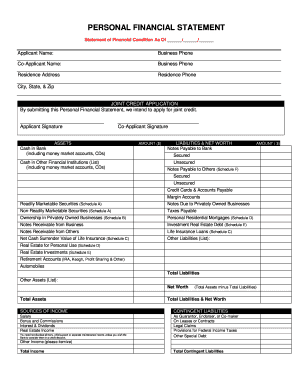

Balance Sheet: This form provides a summary of a company's assets, liabilities, and equity at a specific point in time.

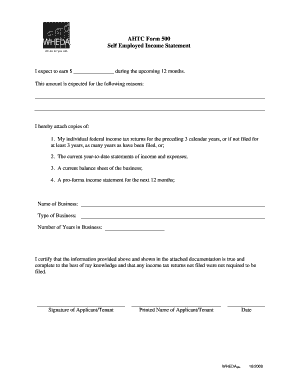

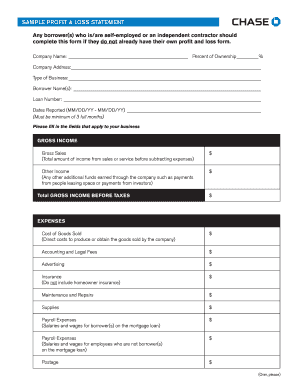

Income Statement: Also known as a profit and loss statement, this form shows a company's revenues, expenses, and net income over a specific period.

Cash Flow Statement: This form details the inflows and outflows of cash in a business, allowing stakeholders to understand how the company manages its funds.

Statement of Retained Earnings: This form outlines the changes in a company's retained earnings over a specific period, showing how profits are reinvested in the business.

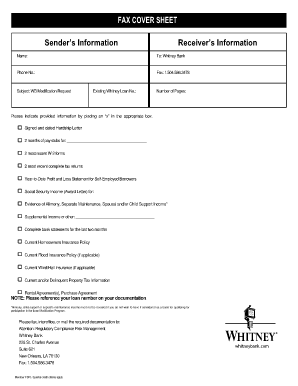

How to complete Business Financial Statement Form

Completing a Business Financial Statement Form may seem daunting, but with the right approach, it can be done efficiently. Here are the steps to follow:

01

Gather all necessary financial documents, such as bank statements, invoices, and receipts.

02

Organize the information into relevant categories, such as income, expenses, assets, and liabilities.

03

Calculate the totals for each category and enter them accurately into the respective sections of the form.

04

Double-check all calculations and ensure that the information provided is accurate and up-to-date.

05

Review the completed form for any errors or inconsistencies before submitting it to the intended recipients.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.