Business Loan Agreement

What is a business loan agreement?

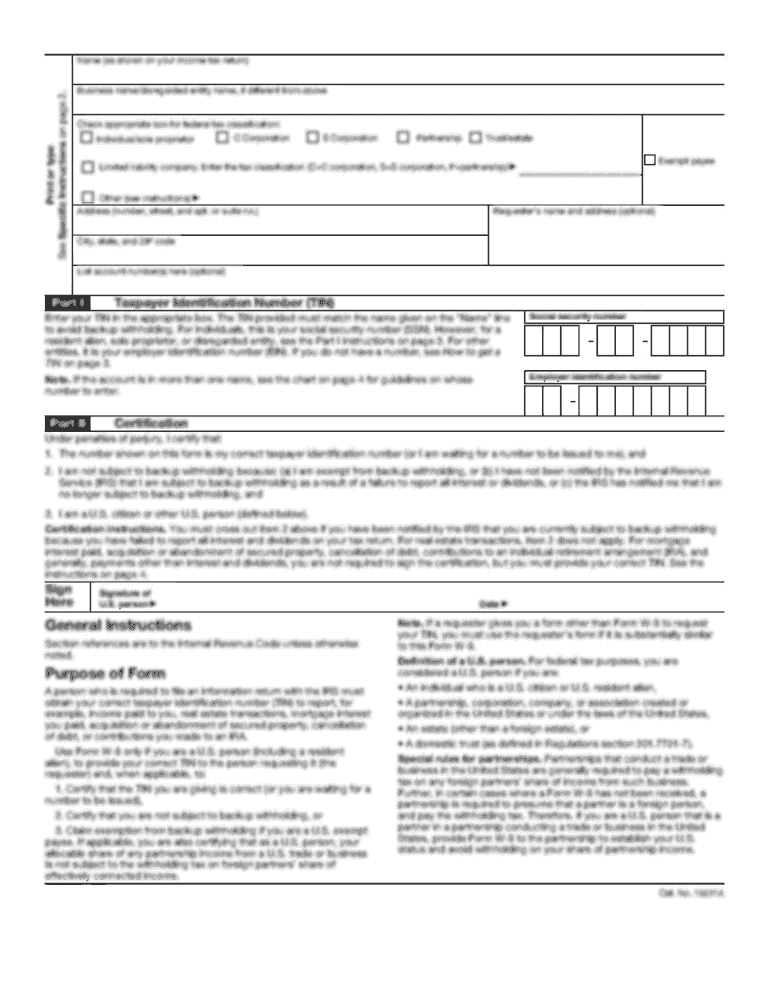

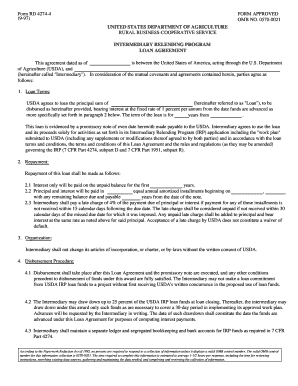

A business loan agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It sets forth the details of the loan, including the loan amount, interest rate, repayment terms, and any collateral or guarantees involved. The agreement serves as a binding contract between the parties, ensuring that both parties understand their rights and obligations.

What are the types of business loan agreement?

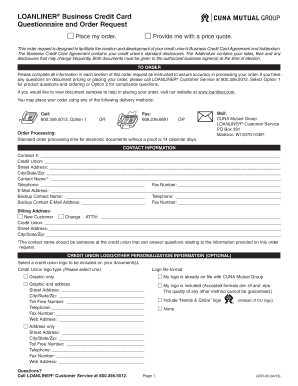

Business loan agreements come in various forms, depending on the specific needs of the borrower and the lender. Some common types of business loan agreements include: 1. Term Loans: These are loans with a fixed repayment schedule, usually over a set number of years. 2. Line of Credit: This type of agreement allows the borrower to withdraw funds up to a certain limit as needed, with interest only charged on the amount borrowed. 3. Equipment Financing: This agreement is used to finance the purchase of specific equipment, with the equipment serving as collateral. 4. Invoice Financing: Also known as accounts receivable financing, this agreement allows businesses to use unpaid invoices as collateral for a loan. 5. SBA Loans: These are loans guaranteed by the U.S. Small Business Administration, which provide favorable terms and conditions to small businesses. These are just a few examples, and there are other types of business loan agreements available depending on the unique circumstances of the borrower.

How to complete a business loan agreement

Completing a business loan agreement involves several steps to ensure all necessary information is included and both parties are in agreement. Here are the steps to follow: 1. Review the agreement: Carefully read through the entire loan agreement, understanding the terms and conditions, and clarifying any uncertainties. 2. Fill in borrower information: Provide all required information about the borrower, such as name, address, contact details, and business information. 3. Specify loan details: Enter the loan amount, interest rate, repayment terms, and any collateral or guarantees involved. 4. Include any additional provisions: If there are any special provisions or conditions that need to be added, make sure to include them in the agreement. 5. Review and sign: Once all the information is filled in, review the agreement again to ensure accuracy and then sign the document. Depending on the lender, this can be done electronically or in person. By following these steps, you can effectively complete a business loan agreement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.