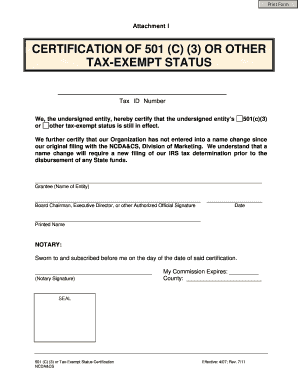

C-3 Form

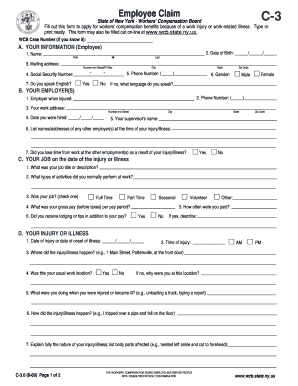

What is c-3 form?

The c-3 form is a tax-exempt organization's request for a determination letter. This letter confirms that the organization qualifies for tax exemption under section 501(c)(3) of the Internal Revenue Code. It is an essential document for non-profit organizations seeking tax-exempt status.

What are the types of c-3 form?

There are two main types of c-3 forms: 1. Form 1023: This is the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. Non-profit organizations must file this form to apply for tax exemption. 2. Form 1023-EZ: This is a streamlined version of Form 1023, designed for certain eligible organizations with less complex financial situations. It simplifies the application process.

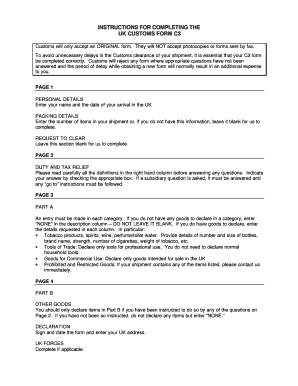

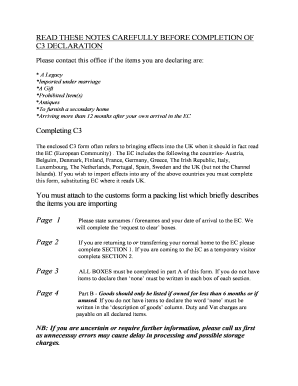

How to complete c-3 form

Completing the c-3 form can seem overwhelming, but with the right guidance, it can be done easily. Here are the steps to complete the c-3 form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.