Canadian Mortgage Calculator

What is Canadian Mortgage Calculator?

A Canadian Mortgage Calculator is a tool that helps users estimate their mortgage payments. It takes into account factors such as the loan amount, interest rate, and amortization period to provide an accurate calculation of how much a borrower will need to pay each month.

What are the types of Canadian Mortgage Calculator?

There are several types of Canadian Mortgage Calculators available to users. Some of the most common types include:

Basic Mortgage Calculator: This calculator provides a simple estimation of monthly mortgage payments based on the loan amount, interest rate, and amortization period.

Affordability Calculator: This calculator helps users determine how much they can afford to borrow by taking into account their income, expenses, and debt.

Income Qualification Calculator: This calculator helps users determine the maximum mortgage amount they qualify for based on their income and expenses.

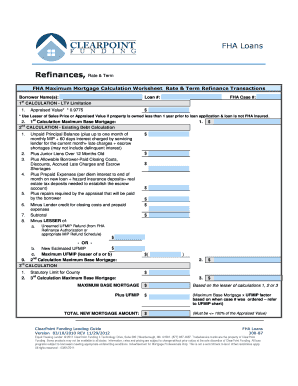

Mortgage Refinance Calculator: This calculator helps users estimate the potential savings of refinancing their mortgage by comparing the current loan terms with new loan terms.

Mortgage Prepayment Calculator: This calculator helps users determine the impact of making additional mortgage payments or increasing the payment amount.

Rent vs. Buy Calculator: This calculator helps users compare the costs of renting versus buying a property to make an informed decision.

Mortgage Comparison Calculator: This calculator allows users to compare different mortgage options by inputting the loan terms and interest rates to see the differences in monthly payments and total costs.

Mortgage Penalty Calculator: This calculator helps users estimate the penalty they may incur if they choose to break their mortgage term early.

How to complete Canadian Mortgage Calculator

Completing a Canadian Mortgage Calculator is easy and straightforward. Here are the steps to follow:

01

Enter the loan amount: Input the total amount of the mortgage loan you wish to calculate.

02

Input the interest rate: Enter the annual interest rate for the mortgage.

03

Set the amortization period: Choose the number of years it will take to pay off the mortgage.

04

Add additional details (optional): Some calculators may allow you to input additional information such as property taxes, insurance, and down payment.

05

Click calculate: Once you have entered all the necessary information, click the calculate button to generate the results.

06

Review the calculated results: The calculator will provide you with the estimated monthly mortgage payment based on the inputted information.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Canadian Mortgage Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create an amortization schedule in Excel?

How to make a loan amortization schedule with extra payments in Excel Define input cells. As usual, begin with setting up the input cells. Calculate a scheduled payment. Set up the amortization table. Build formulas for amortization schedule with extra payments. Hide extra periods. Make a loan summary.

How do I calculate a loan repayment schedule in Excel?

Loan Amortization Schedule Use the PPMT function to calculate the principal part of the payment. Use the IPMT function to calculate the interest part of the payment. Update the balance. Select the range A7:E7 (first payment) and drag it down one row. Select the range A8:E8 (second payment) and drag it down to row 30.

Can I make my own amortization schedule?

You can build your own amortization schedule and include an extra payment each year to see how much that will affect the amount of time it takes to pay off the loan and lower the interest charges.

How do you calculate mortgage payments in Canada?

The simple explanation of this is that loans are usually very simple to deal with, since the interest is compounded with every payment. Therefore, a loan at 6%, with monthly payments and compounding simply requires using a rate of 0.5% per month (6%/12 = 0.5%).A Guide to Mortgage Interest Calculations in Canada. Value EnteredButton Pushed300[n]0.493862[i]1 more row

How do you create a loan amortization schedule?

Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest. Subtract the interest from the total monthly payment, and the remaining amount is what goes toward principal.

What is the formula for a mortgage calculator?

These factors include the total amount you're borrowing from a bank, the interest rate for the loan, and the amount of time you have to pay back your mortgage in full. For your mortgage calc, you'll use the following equation: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1].

Related templates