Car Payment Calculator Excel

What is Car Payment Calculator Excel?

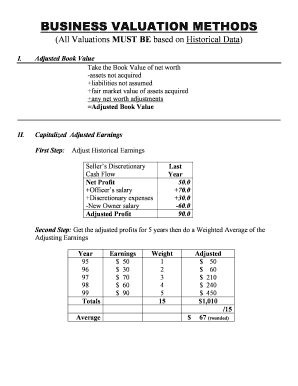

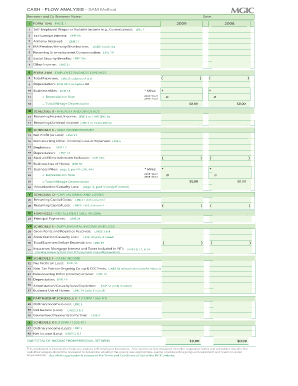

A Car Payment Calculator Excel is a tool used to calculate the monthly payment amount for a car loan. It is specifically designed in Excel format, making it easy to input the necessary data and calculate the results accurately. With the Car Payment Calculator Excel, users can determine how much they will need to pay each month based on factors such as the loan amount, interest rate, and loan term.

What are the types of Car Payment Calculator Excel?

There are several types of Car Payment Calculator Excel available, each designed to cater to specific needs and preferences. Some common types include: 1. Simple Car Payment Calculator: This type of calculator provides basic functionality to calculate the monthly payment based on the loan amount, interest rate, and loan term. 2. Advanced Car Payment Calculator: This type of calculator offers additional features like including taxes, fees, trade-in value, and down payment to provide a more accurate estimate of the monthly payment. 3. Lease Payment Calculator: This type of calculator focuses on calculating the monthly lease payment for leasing a car, taking into account factors such as the lease term, residual value, money factor, and any additional charges.

How to complete Car Payment Calculator Excel

Completing a Car Payment Calculator Excel is a straightforward process. Here's how you can do it:

With pdfFiller, users can easily create, edit, and share Car Payment Calculator Excel documents online. Offering a variety of fillable templates and powerful editing tools, pdfFiller simplifies the process of managing car loan calculations. Whether you need a simple calculator or an advanced one, pdfFiller has got you covered. Start using pdfFiller today and experience the ultimate convenience of working with car loan documents.