Certified Payroll Quickbooks

What is certified payroll in QuickBooks?

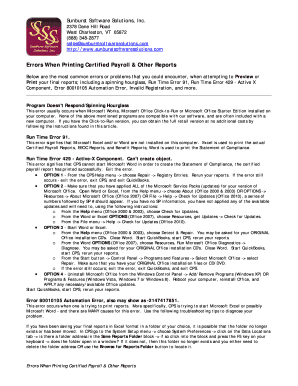

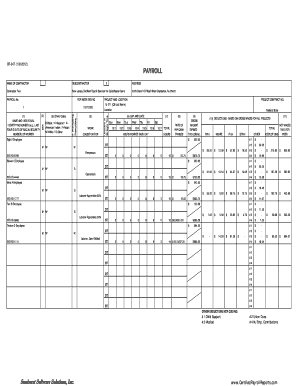

Certified payroll in QuickBooks refers to the process of creating payroll reports that comply with government regulations and requirements. It involves accurately documenting and tracking employee wages, benefits, deductions, and other payroll-related information. QuickBooks provides tools and features to streamline this process and ensure that certified payroll reports are generated accurately and efficiently.

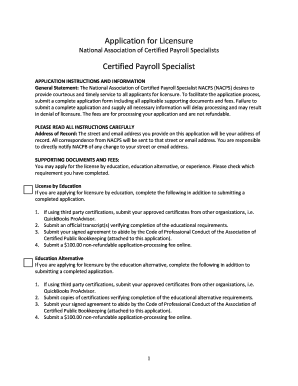

What are the types of certified payroll in QuickBooks?

In QuickBooks, there are two types of certified payroll that you can complete:

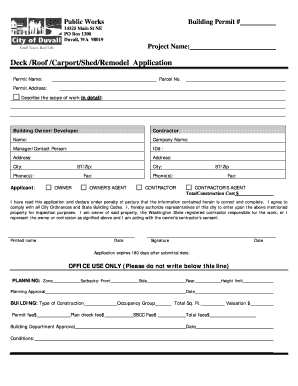

How to complete certified payroll in QuickBooks

To complete certified payroll in QuickBooks, follow these steps:

With pdfFiller, users are empowered to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.