Commercial Loan Credit Memo Template

What is commercial loan credit memo template?

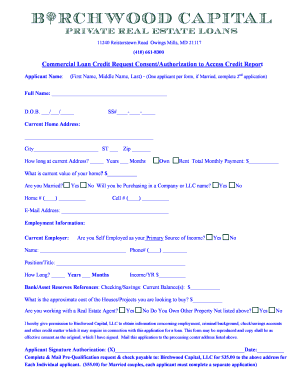

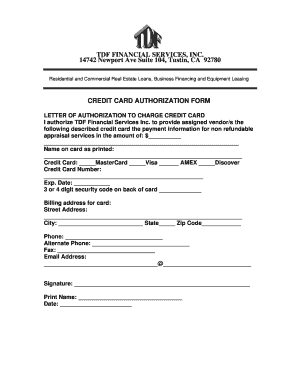

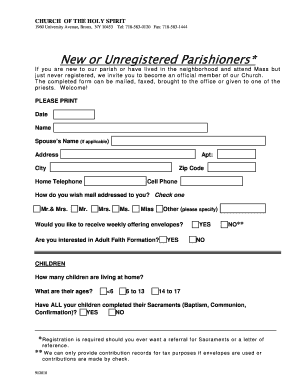

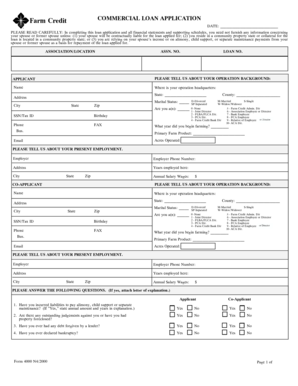

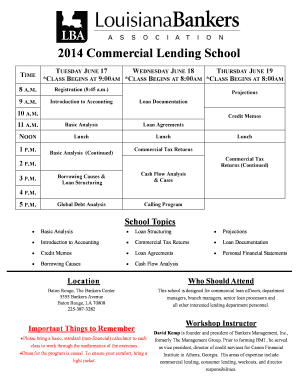

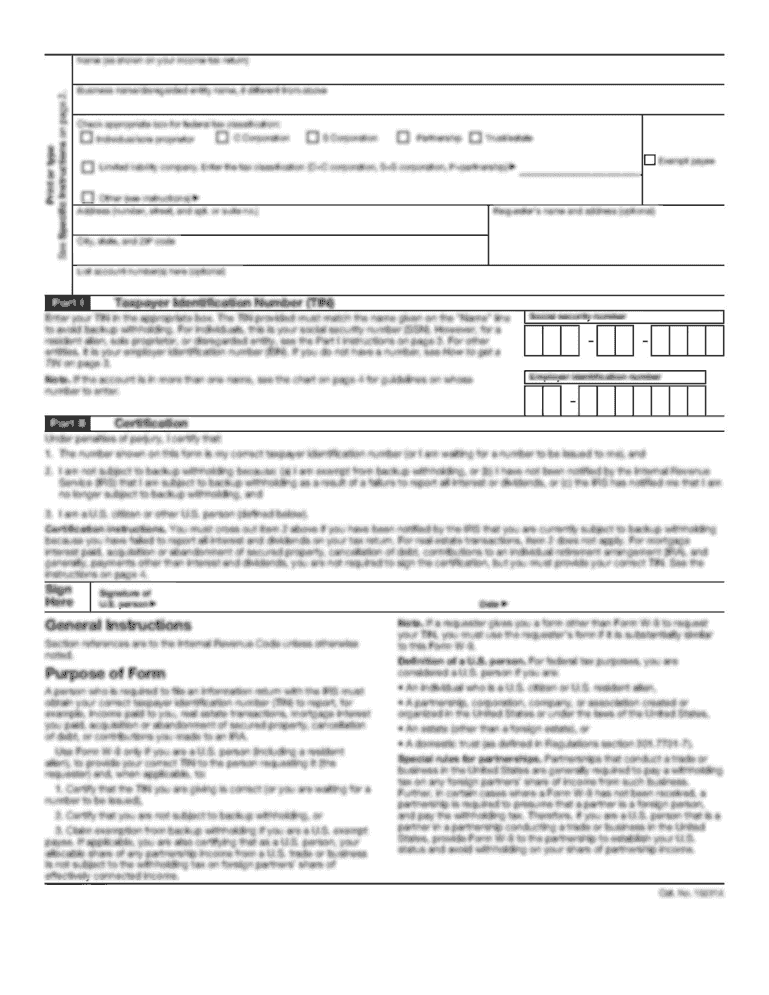

A commercial loan credit memo template is a document that provides information about a commercial loan applicant. It includes details about their financial history, business plan, and other relevant information. This template is used by lenders to assess the creditworthiness of the applicant and make an informed decision about whether to approve the loan or not.

What are the types of commercial loan credit memo template?

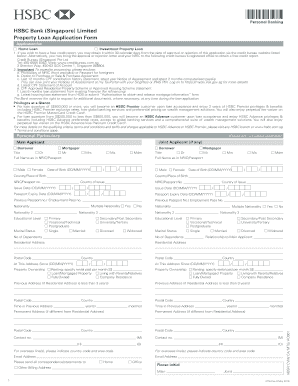

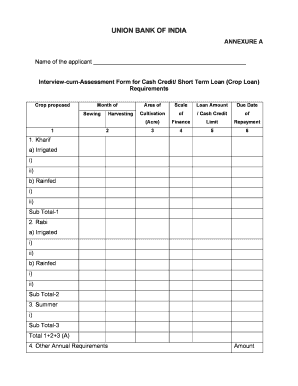

There are several types of commercial loan credit memo templates available, depending on the specific requirements and preferences of the lender. Some common types include: 1. Full Application Memo: This type of template collects comprehensive information about the borrower, including financial statements, credit history, and collateral details. 2. Summary Memo: As the name suggests, this template provides a summary of the borrower's information, highlighting the key factors that lenders typically consider. 3. Small Business Administration (SBA) Memo: SBA loan programs have their own set of templates designed to capture specific information required for SBA-backed loans. 4. Commercial Real Estate Memo: This template focuses on commercial real estate loans, including property details, market analysis, and borrower qualification criteria.

How to complete commercial loan credit memo template

Completing a commercial loan credit memo template can seem overwhelming, but by following these steps, you can ensure a thorough and accurate representation of the borrower's information:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.