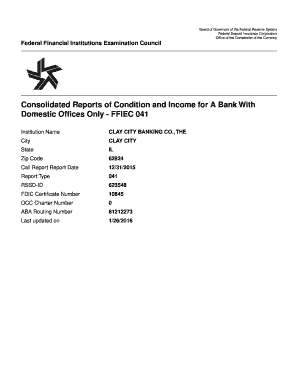

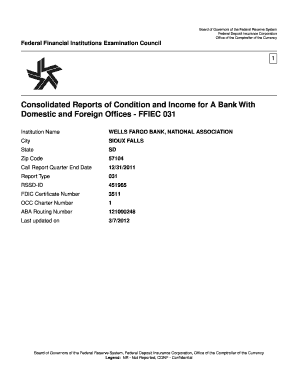

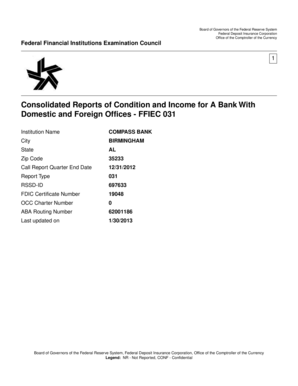

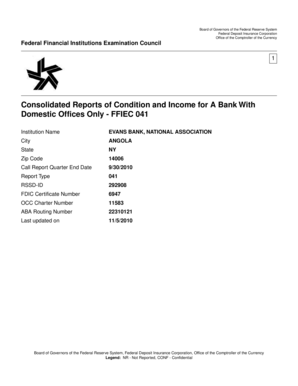

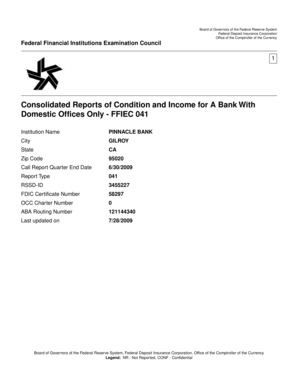

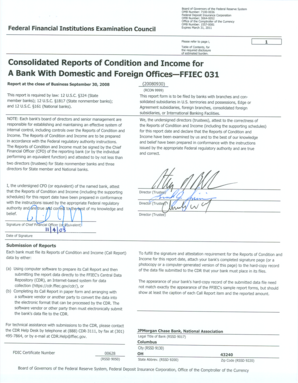

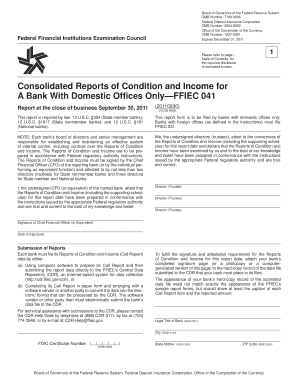

Consolidated Reports Of Condition And Income

What is consolidated reports of condition and income?

Consolidated reports of condition and income, also known as financial statements, are documents that provide a comprehensive overview of an organization's financial performance and position. These reports combine information on the organization's assets, liabilities, income, and expenses to present a clear picture of its financial health. They are essential for stakeholders, including investors, creditors, and regulatory bodies, to evaluate the organization's financial standing.

What are the types of consolidated reports of condition and income?

There are several types of consolidated reports of condition and income. The most common ones are: 1. Balance Sheet: This report presents the organization's assets, liabilities, and shareholders' equity at a specific point in time. It provides information on the organization's financial stability and solvency. 2. Income Statement: Also known as the profit and loss statement, this report highlights the organization's revenue, expenses, gains, and losses over a specific period. It reveals the organization's profitability and performance. 3. Cash Flow Statement: This report tracks the organization's cash inflows and outflows over a specific period. It shows how the organization generates and uses cash, providing insight into its liquidity and cash management. 4. Statement of Changes in Equity: This report details the changes in the organization's shareholders' equity over a specific period. It highlights the contributions, distributions, and retained earnings of the organization's owners.

How to complete consolidated reports of condition and income

Completing consolidated reports of condition and income requires careful attention to detail and adherence to accounting principles. Here are the general steps to follow: 1. Gather financial data: Collect all relevant financial information, including balance sheets, income statements, cash flow statements, and supporting documents. 2. Organize the information: Arrange the financial data in a systematic manner, ensuring accuracy and consistency. 3. Calculate financial ratios: Use the collected data to compute ratios such as liquidity ratios, profitability ratios, and solvency ratios. 4. Prepare the reports: Input the financial data into the appropriate templates or software to generate the consolidated reports of condition and income. 5. Review and validate: Double-check the accuracy and completeness of the reports. Cross-reference the calculations and verify that the information aligns with the supporting documents. 6. Share and distribute: Once finalized, share the consolidated reports with relevant stakeholders, such as management, investors, and regulatory bodies.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.