Corporate Guarantee Format In Word

What is corporate guarantee format in word?

The corporate guarantee format in word refers to the specific structure and layout used for creating a guarantee document in Microsoft Word. This format helps ensure that the guarantee document looks professional and follows the standard guidelines for such agreements.

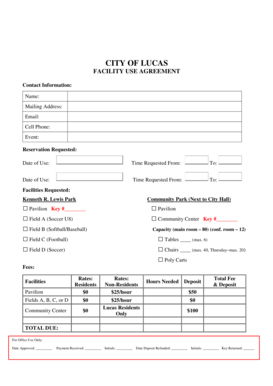

What are the types of corporate guarantee format in word?

There are several types of corporate guarantee formats that can be used in Word. These include:

Standard corporate guarantee format

Corporate guarantee format for loans

Corporate guarantee format for contracts

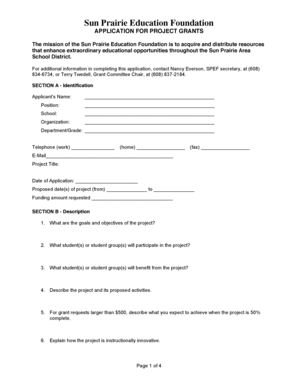

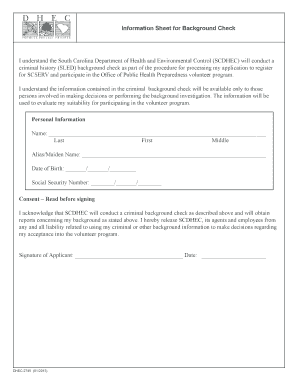

How to complete corporate guarantee format in word

To complete a corporate guarantee format in Word, follow these steps:

01

Open the corporate guarantee document in Word.

02

Fill in the necessary details such as the name of the guarantor, beneficiary, and the guaranteed amount.

03

Review the document for accuracy and make any necessary edits.

04

Save the document and share it with the relevant parties.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out corporate guarantee format in word

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the purpose of a letter of guarantee?

A letter of guarantee is a document issued by your bank that ensures your supplier gets paid for the goods or services it provides to your company, in the event that your company itself can't pay. In that case, your bank will pay your supplier up to a specified amount.

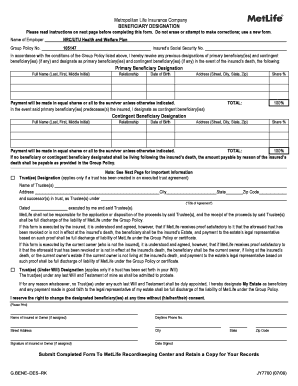

What is a guarantee form?

(ˌɡærənˈtiː fɔːm ) law. a document that spells out the terms of a legally binding guarantee.

What is a corporate guarantee?

A guarantee in which a corporation agrees to be held responsible for completing the duties and obligations of a Sponsor, in the event that the Sponsor fails to fulfill the terms of the contract.

What is one reason a letter of guarantee would be issued?

A letter of Guarantee is a written consent issued by the bank stating that if the concerned customer fails to make the payment for goods purchased from the supplier, then the bank will pay on the customer's behalf. It helps the supplier to have confidence in the transaction and supply the product.

Can a corporation be a guarantor?

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

What is guaranteed document?

Guaranteed Documents means the Credit Agreement, the Notes, any Letter of Credit and all other Loan Documents to which any Credit Party or any of its Subsidiaries is now or may hereafter become a party, but only to the extent that the Parent Foreign Borrower is a party.

Related templates