Corporate Guarantee Vs Bank Guarantee

What is corporate guarantee vs bank guarantee?

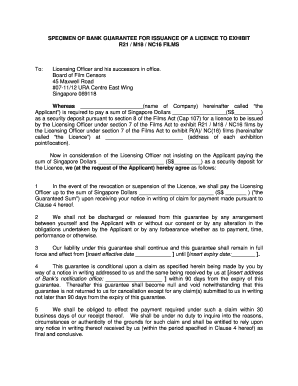

A corporate guarantee and a bank guarantee are both types of financial instruments that provide a form of assurance or security. However, there are some key differences between the two. A corporate guarantee is a promise made by one company to fulfill the financial obligations of another company in the event that the second company defaults on its obligations. This means that if one company fails to meet its contractual or financial obligations, the other company will step in and assume responsibility for those obligations. On the other hand, a bank guarantee is a promise made by a bank to compensate a beneficiary if the principal debtor fails to fulfill its obligations. In this case, the bank acts as a guarantor for the debtor and assures the beneficiary that they will receive payment if the debtor fails to make the required payment. Both corporate guarantees and bank guarantees serve as forms of security, but they differ in terms of the entities involved and the circumstances in which they are used.

What are the types of corporate guarantee vs bank guarantee?

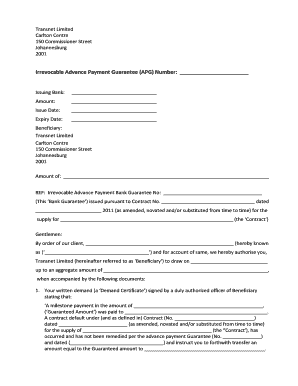

There are different types of corporate guarantees and bank guarantees, each serving a specific purpose. Let's take a look at the types for each: Corporate Guarantee: 1. Performance Guarantee: This type of guarantee ensures that the company will fulfill its contractual obligations. 2. Financial Guarantee: This guarantee ensures that the company will meet its financial obligations, such as making loan repayments or paying off debts. 3. Deferred Payment Guarantee: This guarantee allows a company to defer its payment obligations for a specific period of time. Bank Guarantee: 1. Payment Guarantees: These guarantees assure the beneficiary that they will receive payment on behalf of the debtor if the debtor fails to fulfill its payment obligations. 2. Bid Bonds: These guarantees are often used in the bidding process for contracts or projects and assure the beneficiary that the bidder will enter into the contract if selected. 3. Advance Payment Guarantees: These guarantees secure the advance payment made by a buyer to a seller, ensuring that the seller will fulfill its obligations. These are just a few examples of the types of corporate guarantees and bank guarantees available. The chosen type depends on the specific needs and circumstances of the parties involved.

How to complete corporate guarantee vs bank guarantee

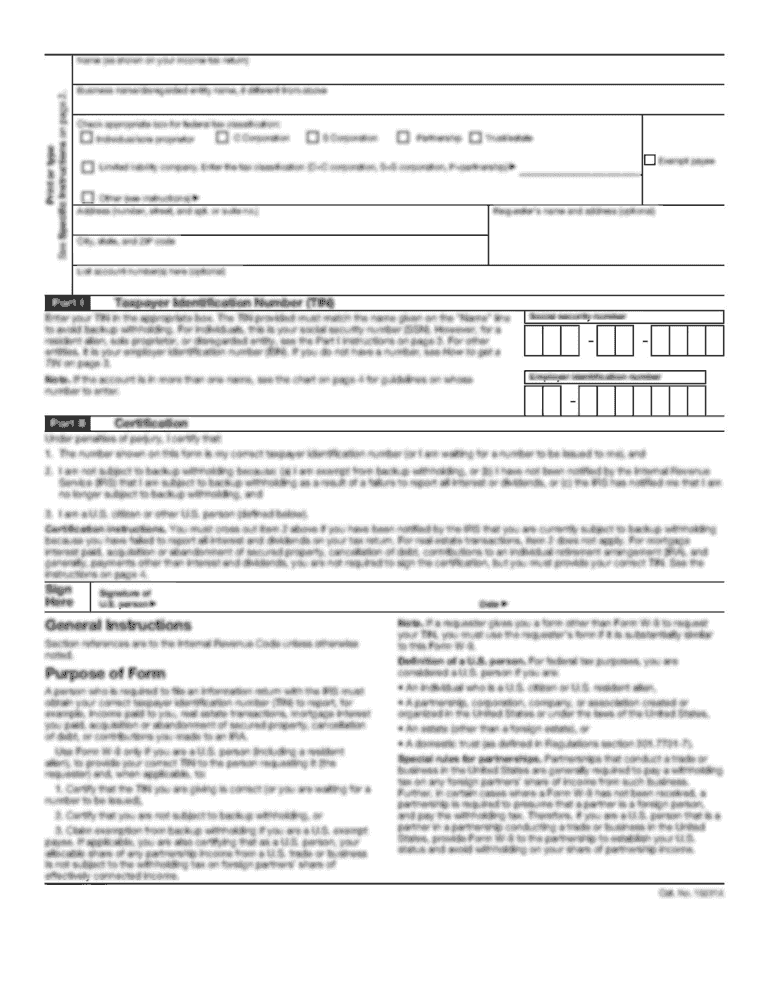

Completing a corporate guarantee or a bank guarantee involves several steps to ensure that all parties are protected and the guarantee is valid. Here is a step-by-step guide: 1. Understand the requirements and obligations: Read and comprehend the terms and conditions of the guarantee thoroughly. Understand the obligations of both parties involved. 2. Provide necessary documentation: Gather and submit any required documentation, such as financial statements, legal agreements, or company information. 3. Draft the guarantee agreement: Prepare and review the guarantee agreement, ensuring that it includes all necessary details and provisions. 4. Obtain approval: Seek approval from all relevant parties involved, such as shareholders, management, or the bank. 5. Sign and execute the agreement: Once all parties are satisfied with the terms, sign the guarantee agreement and ensure it is properly executed. 6. Monitor and fulfill obligations: Continuously monitor the obligations outlined in the guarantee agreement and ensure they are fulfilled in a timely manner. By following these steps, you can effectively complete a corporate guarantee or a bank guarantee and safeguard your interests.

pdfFiller's comprehensive suite of tools can assist you in creating and managing your guarantee agreements efficiently. With its user-friendly interface and powerful features, pdfFiller ensures a seamless experience for users in completing corporate guarantees or bank guarantees.