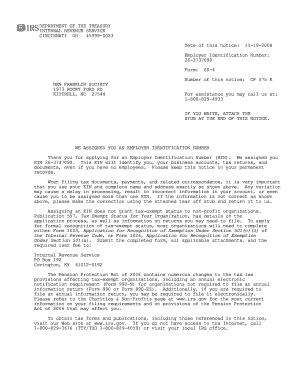

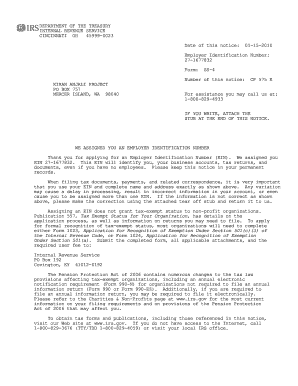

Corporate Tax Form

What is Corporate Tax Form?

A Corporate Tax Form is a document that businesses are required to file to report their income, deductions, and tax liabilities to the government. It is used by corporations and other types of business entities to fulfill their tax obligations. This form provides the government with important financial information about the company's revenue and allows the government to calculate the amount of tax that needs to be paid by the business.

What are the types of Corporate Tax Form?

There are several types of Corporate Tax Forms that businesses may be required to file. The most common type is Form 1120, which is used by C corporations. S corporations, on the other hand, use Form 1120S. Other types of business entities, such as partnerships and limited liability companies (LLCs), may have different tax forms, such as Form 1065 or Form 1120-REIT. It is important for businesses to determine the correct form to file based on their legal structure and tax requirements.

How to complete Corporate Tax Form

Completing a Corporate Tax Form may seem daunting, but with the right information and guidance, it can be done efficiently. Here are some steps to help you complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.