Create A Living Trust Online Free

What is create a living trust online free?

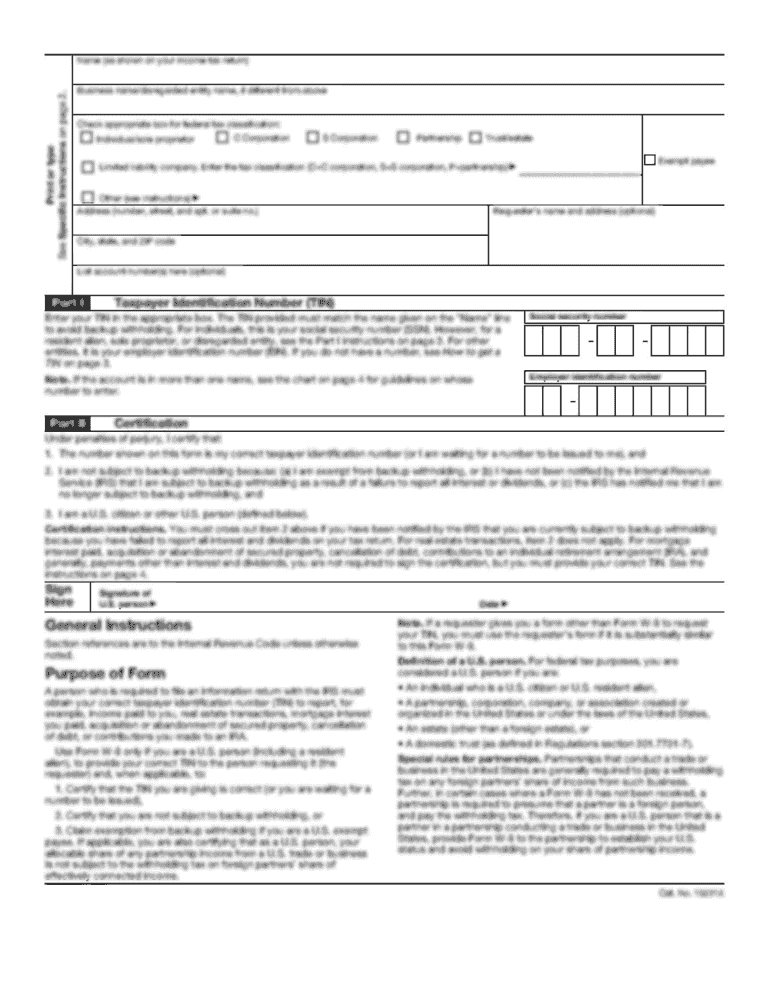

Creating a living trust online for free is a convenient and cost-effective way to ensure your assets and property are handled according to your wishes after your passing. With online resources, you can easily access the necessary tools to guide you through the process of creating a living trust without incurring any fees.

What are the types of create a living trust online free?

When it comes to creating a living trust online for free, there are various options available. Some popular types include: 1. Revocable Living Trust: Allows you to make changes or revoke the trust during your lifetime. 2. Irrevocable Living Trust: Once established, it cannot be changed or revoked without the consent of the beneficiaries. 3. Testamentary Living Trust: Created through your last will and testament, it only goes into effect after your passing. These types cater to different circumstances and priorities, so it's important to choose the one that best fits your needs and goals.

How to complete create a living trust online free

Completing the process of creating a living trust online for free is straightforward and user-friendly. Here are the steps to follow:

By utilizing the empowering features of pdfFiller, a leading online platform for document management, you can confidently create, edit, and share your living trust online for free. With unlimited fillable templates and powerful editing tools, pdfFiller ensures that your living trust documents are finalized efficiently and accurately.