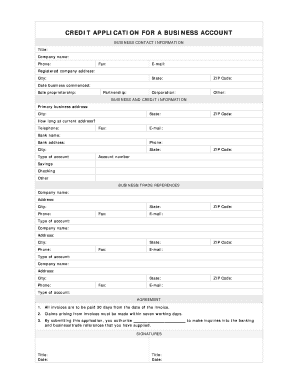

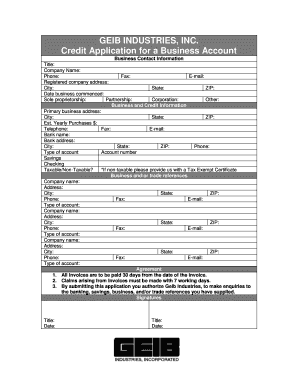

Credit Application For A Business Account - Page 2

Video Tutorial How to Fill Out Credit Application For A Business Account

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you ask a customer to fill out a credit application?

“Hi Joe, I am very happy to know that you will be awarding us with new business, and I want to make sure we can accommodate your future needs in regards to credit. My bank requires that we have your company credit application on file as part of their guidelines in establishing credit with our customers.

What questions are asked on a credit application?

What questions will I be asked on the application? Social Security number. Income. Date of birth. Security questions. Contact information. A promise to tell the truth. Agreement to terms and conditions. Authorized users.

How do you process a credit application?

A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises. A credit application should have all requested details, without which the lender will not be able to proceed with a credit application.

How do you write a credit application?

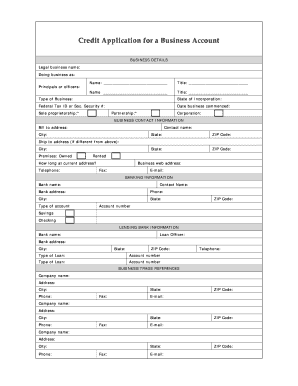

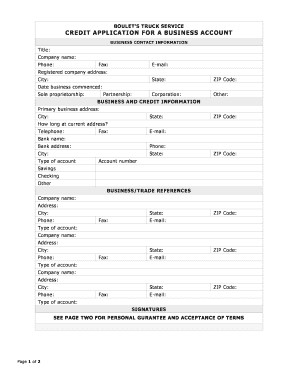

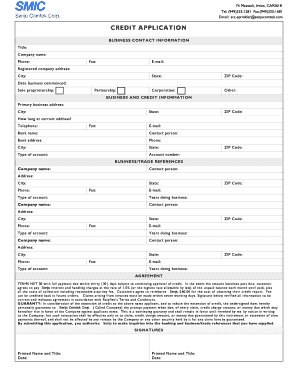

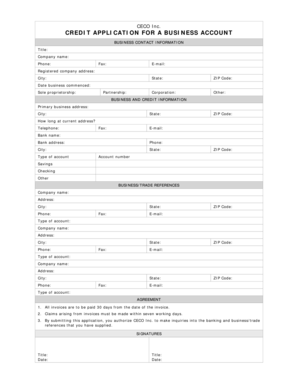

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line.

How do I fill out a credit application for my business?

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

What are the steps in the credit application process?

While granting customer credit, the sales associate has to follow certain steps, which include creation of credit policy, obtaining credit application, checking customer references, getting a personal guarantee, run a credit check, setting limits of credit and payment terms.

Related templates