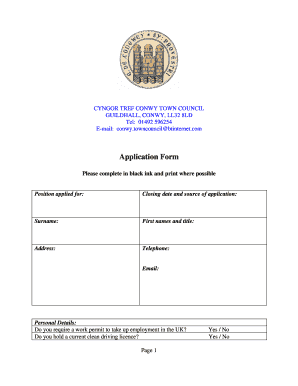

What is credit application form template uk?

A credit application form template UK is a standardized document that is used by individuals or businesses to apply for credit from a financial institution or lender. It contains fields for personal and financial information, such as name, address, income, and employment details. The form serves as a tool for lenders to assess the creditworthiness of the applicant and make an informed decision about whether to approve the credit application.

What are the types of credit application form template UK?

There are various types of credit application form templates available in the UK, each designed to cater to different needs and requirements. Some common types include:

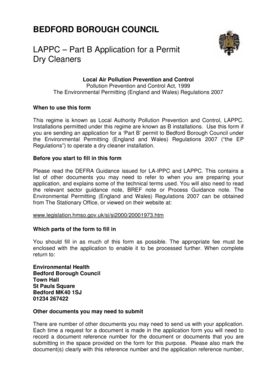

Personal credit application form template: Used by individuals to apply for personal credit, such as loans or credit cards.

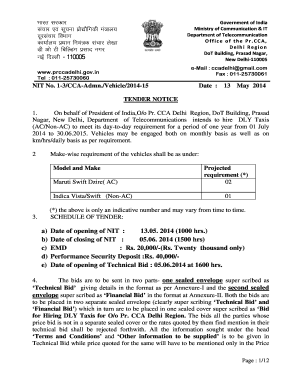

Business credit application form template: Used by businesses to apply for credit, such as loans or trade credit.

Mortgage application form template: Specifically designed for individuals applying for a mortgage loan to purchase or refinance a property.

Auto loan application form template: Used by individuals seeking financing for a vehicle purchase.

How to complete credit application form template UK

Completing a credit application form template UK can be a straightforward process if you follow these steps:

01

Review the form: Read through the form instructions and requirements before filling it out.

02

Gather necessary information: Ensure you have all the required personal and financial information, such as identification documents, proof of income, and employment details.

03

Fill in the form: Enter the requested information accurately and honestly. Double-check for any errors or missing information.

04

Attach supporting documents: If required, attach any supporting documents requested by the lender, such as bank statements or pay stubs.

05

Submit the application: Once you have completed the form and gathered all necessary documents, submit the application to the lender through the designated channel, such as online submission or in-person at a branch.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.