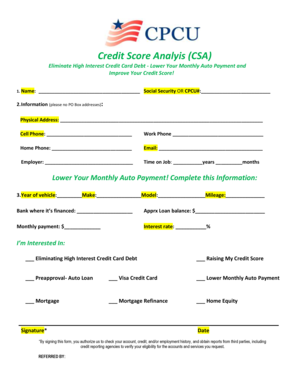

What is credit card debt elimination?

Credit card debt elimination refers to the process of paying off outstanding balances on credit cards. It involves reducing or completely eliminating the amount owed to credit card companies. By eliminating credit card debt, individuals can improve their financial situation and reduce the burden of high-interest payments.

What are the types of credit card debt elimination?

There are several types of credit card debt elimination strategies that individuals can consider:

Debt Snowball Method: This method involves paying off credit card debts from smallest to largest balances, regardless of interest rates. It focuses on building momentum and motivation by eliminating smaller debts first.

Debt Avalanche Method: This method prioritizes paying off credit card debts with the highest interest rates first, regardless of the outstanding balance. It aims to minimize the overall interest paid over time.

Debt Consolidation: This involves combining multiple credit card debts into a single loan with a lower interest rate. It simplifies the repayment process and can potentially reduce monthly payments.

Balance Transfer: This strategy involves transferring high-interest credit card balances to a new credit card with a lower or zero-percent introductory interest rate. It can provide temporary relief from high-interest payments.

Negotiating with Credit Card Companies: Individuals can negotiate with credit card companies to lower interest rates, waive fees, or establish a more manageable repayment plan. This strategy requires effective communication and negotiation skills.

How to complete credit card debt elimination

Completing credit card debt elimination requires commitment, discipline, and a strategic approach. Here are steps to help you achieve this goal:

01

Assess your current financial situation: Take an inventory of all your credit card debts, interest rates, and minimum payments. Analyze your income, expenses, and prioritize your debts.

02

Create a budget: Develop a realistic budget that allows you to allocate funds towards debt repayment. Cut unnecessary expenses and redirect the savings towards paying off credit card debts.

03

Choose a debt elimination strategy: Consider the different types of credit card debt elimination strategies mentioned earlier and select the one that aligns with your financial goals and preferences.

04

Set a repayment plan: Determine how much you can afford to pay each month towards credit card debts. Stick to the plan and make consistent payments to eliminate your debts.

05

Seek professional advice if needed: If you feel overwhelmed or unsure about the best approach to credit card debt elimination, consult with a financial advisor or credit counseling agency for guidance.

06

Monitor your progress: Regularly track your progress and celebrate milestones along the way. Adjust your strategies if necessary and remain focused on your goal of eliminating credit card debt.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.