Credit Card Payment Calculator - Page 2

What is Credit Card Payment Calculator?

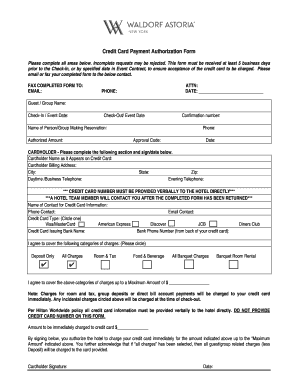

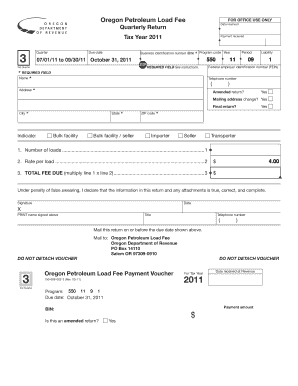

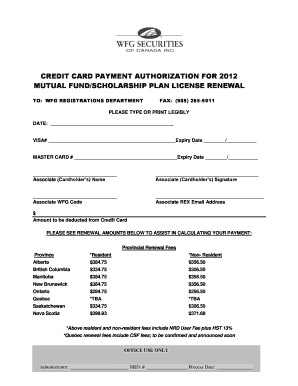

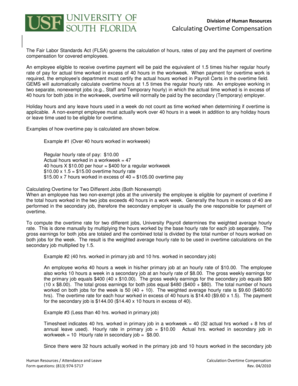

A Credit Card Payment Calculator is a helpful tool that allows users to calculate their credit card payments. It helps users determine how much they need to pay each month to pay off their credit card balance within a certain timeframe. By entering details such as the outstanding balance, interest rate, and desired payoff period, users can get an estimate of their monthly payments.

What are the types of Credit Card Payment Calculator?

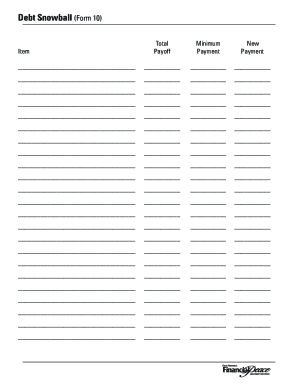

There are several types of Credit Card Payment Calculators available to users. These include: 1. Minimum Payment Calculator: This calculator helps users determine the minimum payment required to avoid late fees and penalties. 2. Payoff Calculator: This calculator helps users determine how long it will take to pay off their credit card balance based on their current payment amount. 3. Balance Transfer Calculator: This calculator helps users calculate the potential savings and time required by transferring their balance to a card with a lower interest rate.

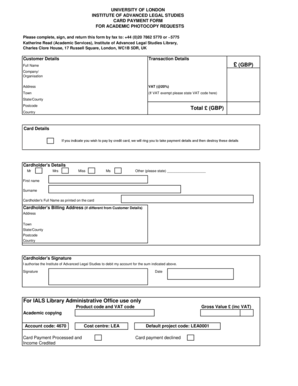

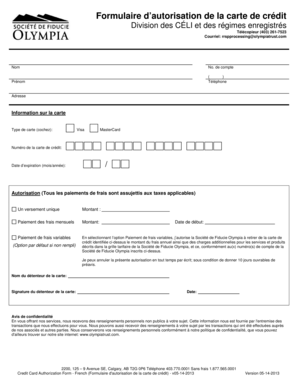

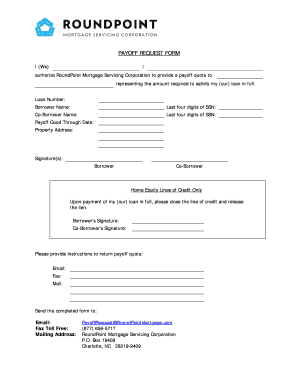

How to complete Credit Card Payment Calculator

Completing a Credit Card Payment Calculator is quick and easy. Here are the steps you need to follow: 1. Enter the outstanding balance of your credit card. 2. Input the interest rate charged on your credit card. 3. Choose the desired payoff period. 4. Click the 'Calculate' button to get the estimated monthly payment. 5. Review the results and adjust the inputs as needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.