Credit Request Form Template

What is credit request form template?

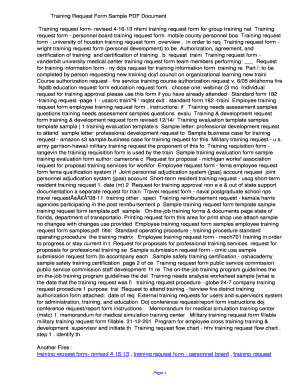

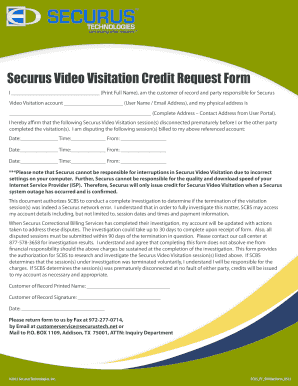

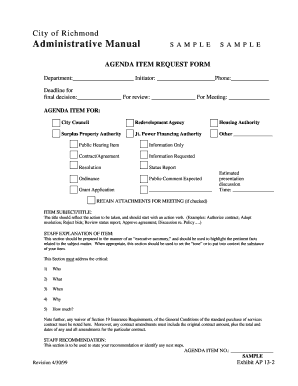

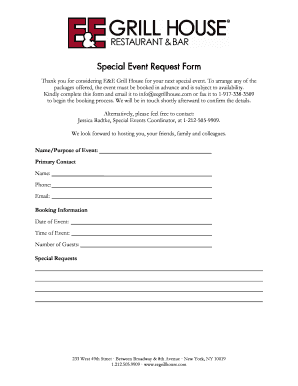

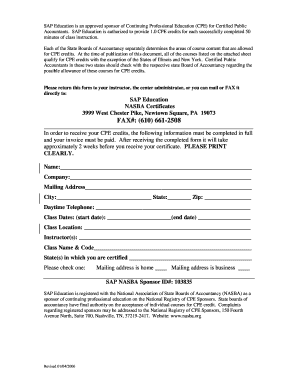

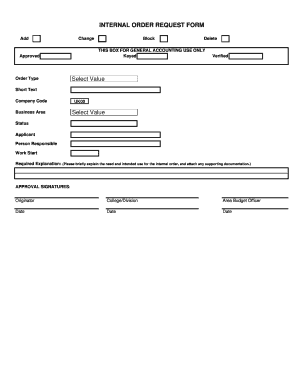

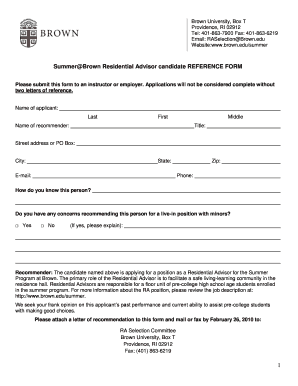

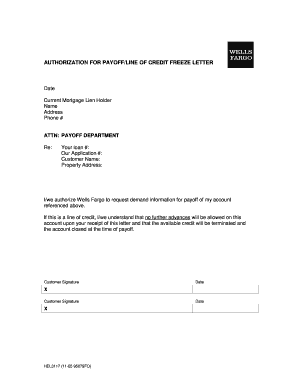

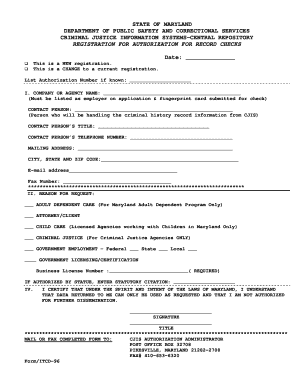

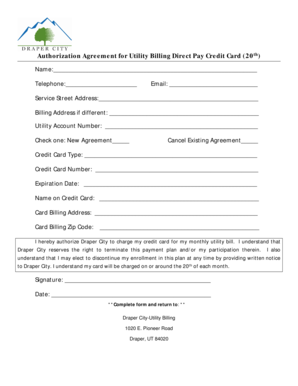

A credit request form template is a pre-designed document that allows individuals or businesses to request credit from a financial institution or lender. It typically includes sections to provide personal and contact information, details about the requested credit amount, purpose of the credit, and any additional supporting documents that may be required.

What are the types of credit request form template?

There are various types of credit request form templates available, depending on the specific needs of the borrower and the financial institution or lender. Some common types of credit request form templates include: 1. Personal Credit Request Form: Used by individuals to request personal credit for purposes such as home loans, car loans, or personal lines of credit. 2. Business Credit Request Form: Used by businesses to request credit for business-related purposes such as funding for expansion, equipment purchases, or working capital. 3. Mortgage Credit Request Form: Specifically designed for individuals or businesses seeking mortgage loans to purchase property or refinance existing mortgages. 4. Student Loan Credit Request Form: Used by students or their parents to request credit for educational expenses such as tuition fees, books, or living expenses.

How to complete credit request form template

Completing a credit request form template can be done in few simple steps to ensure accurate and prompt processing. Here is a step-by-step guide: 1. Download or access the credit request form template online. 2. Provide your personal or business information, including full name, contact details, and any identification numbers required. 3. Specify the type and amount of credit you are requesting, along with the purpose of the credit. 4. Fill in any additional sections or questions specific to the chosen credit request form template. 5. Gather any supporting documents that may be required, such as proof of income, tax returns, business plans, or identification documents. 6. Review the completed form to ensure all information is accurate and complete. 7. Save a copy of the completed form for your records. 8. Submit the credit request form to the appropriate financial institution or lender, either online or by printing and mailing it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.