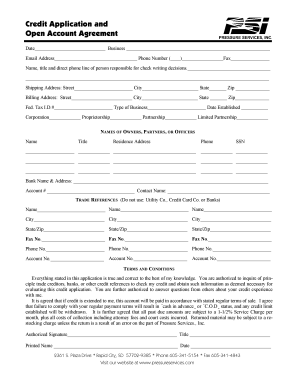

Customer Credit Application Form And Agreement

What is customer credit application form and agreement?

A customer credit application form and agreement is a document that customers fill out when applying to establish a line of credit with a company. This form collects important information about the customer, such as their personal details, financial information, and credit history. The agreement portion outlines the terms and conditions of the credit agreement, including interest rates, payment terms, and any penalties for late payments or defaults.

What are the types of customer credit application form and agreement?

There are several types of customer credit application forms and agreements, depending on the specific needs of the business. Some common types include: 1. Individual Credit Application Form and Agreement: This type is used when an individual applies for credit on their own behalf. 2. Joint Credit Application Form and Agreement: This type is used when two or more individuals apply for credit together, such as a married couple. 3. Business Credit Application Form and Agreement: This type is used when a business entity applies for credit, and it includes additional information about the business, such as tax identification numbers and financial statements.

How to complete customer credit application form and agreement

Completing a customer credit application form and agreement is a relatively straightforward process. Here are the steps to follow: 1. Fill out personal information: Provide your full name, contact details, and social security number. 2. Provide financial information: Include your income, employment details, and any existing debts. 3. Provide references: Some credit applications may require you to provide references who can vouch for your reliability as a borrower. 4. Review and sign the agreement: Carefully read through the terms and conditions of the credit agreement, and sign it if you agree to the terms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.