Debt Reduction Calculator

What is Debt Reduction Calculator?

A Debt Reduction Calculator is a tool that helps individuals or organizations estimate and plan their debt repayment strategy. It allows users to input their various debts, including loan amounts, interest rates, and repayment terms, and calculates the most efficient way to pay off the debts.

What are the types of Debt Reduction Calculator?

There are several types of Debt Reduction Calculators available, including:

Snowball method calculator

Avalanche method calculator

Debt consolidation calculator

How to complete Debt Reduction Calculator

To complete a Debt Reduction Calculator, follow these steps:

01

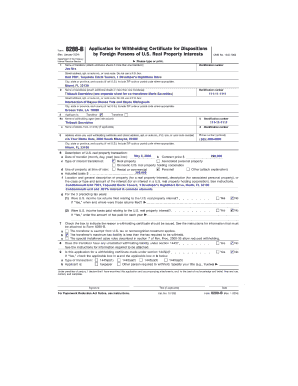

Gather all necessary information about your debts, including loan amounts, interest rates, and repayment terms.

02

Input the information into the calculator, making sure to enter accurate data.

03

Review the calculated results, which may include recommended payment amounts and schedules.

04

Implement the recommended debt repayment strategy and track your progress.

05

Regularly update and review the calculator as your debt situation changes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Debt Reduction Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 2 most common methods for paying down debt?

The debt avalanche method involves making minimum payments on all debt, then using any extra funds to pay off the debt with the highest interest rate. The debt snowball method involves making minimum payments on all debt, then paying off the smallest debts first before moving on to bigger ones.

How do I calculate debt paydown in Excel?

The answer is given by the formula: N = -log(1 – (Ai / P)) / log (1 + i) where: N = total number of repayment periods. A = amount borrowed.

How do you use a debt snowball worksheet?

Here's how the debt snowball works: Step 1: List your debts from smallest to largest regardless of interest rate. Step 2: Make minimum payments on all your debts except the smallest. Step 3: Pay as much as possible on your smallest debt. Step 4: Repeat until each debt is paid in full.

How do you create a debt free plan?

Make a List of Your Debts. Analyze Your Spending. Create a Budget. Plan How to Pay Down Debt. Track Your Progress. Seek Help. Debt Elimination Tips.

How do you create a debt reduction spreadsheet?

Step 1: Look up your individual debts and interest rates Step 2: Input your debt information into your debt snowball spreadsheet. Step 3: Add Dates in Column A of Your Debt Payoff Spreadsheet. Step 4: Calculate how much you actually pay off with each payment. Step 5: Calculate the Debt Snowball Spreadsheet in Action.

Is the debt snowball a good idea?

The truth about the debt snowball method is it's a motivational program that can work at eliminating debt, but it's going to cost you more money and time – sometimes a lot more money and a lot more time – than other debt relief options.

Related templates