What is deed of trust form oregon?

A deed of trust form in Oregon is a legal document that establishes a lien on a property to secure a loan. It is commonly used in real estate transactions as an alternative to a mortgage. The deed of trust allows the lender to take possession of the property if the borrower defaults on the loan. It is an important document that protects the rights of both the borrower and the lender.

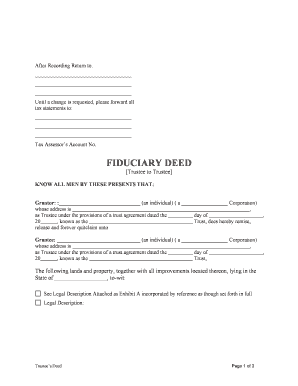

What are the types of deed of trust form oregon?

There are different types of deed of trust forms in Oregon, depending on the specific situation and requirements of the parties involved. Some common types include:

General Deed of Trust: This is the most common type and is used for standard real estate transactions.

Subordination Deed of Trust: This type of deed of trust is used when there are multiple loans on a property, and it determines the priority of each loan in case of default.

Wraparound Deed of Trust: This type of deed of trust is used when there is an existing loan on a property, and a new loan is created that wraps around the existing loan. It allows the borrower to consolidate the loans and make a single payment.

Construction Deed of Trust: This type of deed of trust is used when a property is being constructed or renovated. It provides security for the lender during the construction process.

Assignment of Rents and Leases: This type of deed of trust allows the lender to collect rent from tenants in case of default by the borrower.

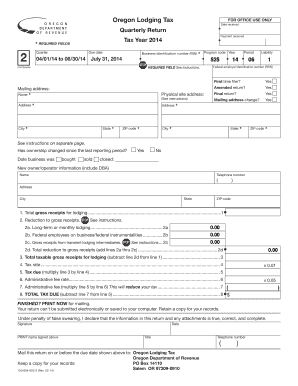

How to complete deed of trust form oregon

Completing a deed of trust form in Oregon may seem daunting, but with the right guidance, it can be a smooth process. Follow these steps to complete the form:

01

Obtain the correct deed of trust form: Make sure you have the latest version of the deed of trust form specifically designed for Oregon.

02

Identify the parties involved: Enter the names and contact information of the borrower (trustor), lender (beneficiary), and trustee.

03

Describe the property: Provide a detailed description of the property, including its address and legal description.

04

Specify the loan details: State the loan amount, interest rate, and repayment terms.

05

Sign and notarize the deed of trust: All parties involved must sign the form in the presence of a notary public.

06

File the deed of trust: Record the completed deed of trust with the county recorder's office where the property is located.

pdfFiller is a revolutionary online platform that empowers users to create, edit, and share documents seamlessly. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that enables users to effortlessly get their documents done. It is an invaluable tool for anyone involved in the creation and management of legal documents such as deed of trust forms in Oregon.