Document Retention Policy Irs

What is document retention policy irs?

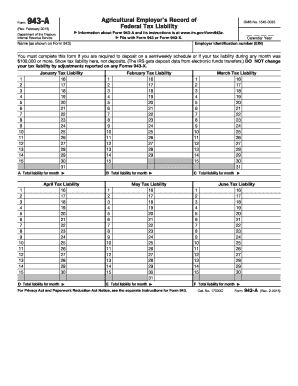

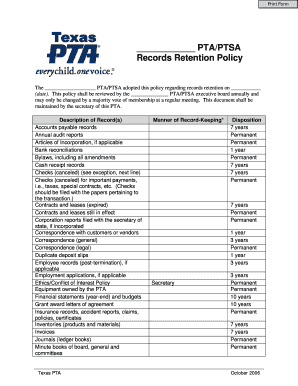

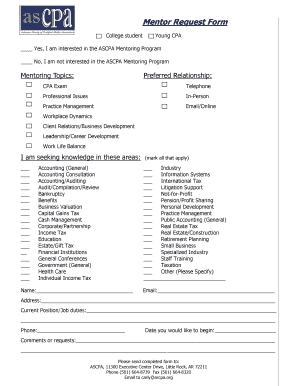

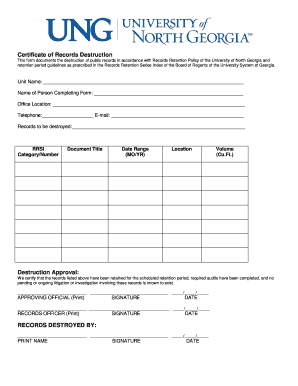

Document retention policy IRS refers to the guidelines set by the Internal Revenue Service regarding the storage and disposal of financial and tax-related documents.

What are the types of document retention policy irs?

There are two main types of document retention policy IRS: temporary retention and permanent retention.

Temporary retention involves keeping documents for a set period of time before disposing of them based on IRS guidelines.

Permanent retention requires holding onto certain documents indefinitely, such as tax returns and legal agreements.

How to complete document retention policy irs

Completing a document retention policy IRS is simple and crucial for staying organized and compliant with tax laws.

01

Determine which documents are subject to IRS retention requirements.

02

Set up a filing system that clearly labels and organizes all documents.

03

Regularly review and update the policy to ensure compliance with current regulations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a good document retention policy?

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer and state record-keeping agency may provide guidance.

How do you write a record retention policy?

How to create a record retention policy Conduct an audit of your data and organize your files. Determine how long you're required to keep certain documents. Explain what and who the policy covers in the scope. Write the body of the policy. Add an appendix to define complex terms.

Do nonprofits need a document retention policy?

Although retention periods vary for different types of records or documents, nonprofit organizations should have a written, mandatory policy for document retention and destruction policies. All staff should be familiar with these policies so they can keep appropriate records and not destroy any unwittingly.

How long should a 501c3 keep financial records?

Keep for minimum of seven years: Bank statements, checks, deposit records and reconciliation. Contracts, mortgages (expired) Contracts (until 7 years after expiration) Donation Documentation.

How long should records be kept for a nonprofit organization?

How Long to Keep Records? All records should be kept by a nonprofit organization until the statute of limitations is up. This means that any documents needed for federal tax purposes should be kept safely until the tax year has long past, treating three years as a good rule of thumb for document retention.

How long should documents be retained?

Knowing that, a good rule of thumb is to save any document that verifies information on your tax return—including Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receipts—for three to seven years.

Related templates