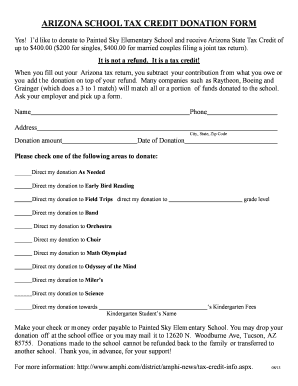

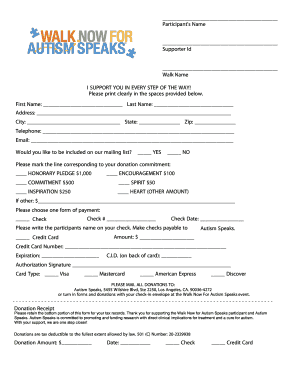

Donation Form For Taxes

Video Tutorial How to Fill Out donation form for taxes

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do I have to report donations to me on my taxes?

If no goods or services were received in exchange, these contributions would be treated as gifts and would not be taxable to the recipient. However, if the donor exceeds the “annual gift tax exclusion” ($15,000 per donee per year), they may be required to file a federal gift tax return to report their gift.

How do I claim $300 charitable deductions?

The $300 deduction is for donations made in cash, which includes currency, checks, credit or debit cards, and electronic funds transfers. You can't take the deduction for contributions of property, such as clothing or household items. You must also make your contributions to qualified charities.

Will there be a $300 charitable deduction in 2022?

Unfortunately, as of April 2022, the answer is no. In the 2021 tax year, the IRS temporarily allowed individuals to deduct $300 per person (those married filing jointly can deduct up to $600) without itemizing other deductions. But that change does not apply to the 2022 tax year.

Do you have to claim money donated to you on taxes?

For the 2021 tax year only, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. The CARES Act eliminated the 60% limit for cash donations to public charities.

Can you deduct 300 in charitable contributions without itemizing?

Single taxpayers can claim a tax write-off for cash charitable gifts up to $300 and married couples filing together may get up to $600 for 2021. The tax break is available even if you claim the standard deduction and don't itemize.

Where do I enter $300 charitable deductions in Turbotax?

You can deduct up to $300 of qualified charitable cash contributions ($600 if married filing a joint tax return) from your adjusted gross income without itemizing deductions. To claim qualified charitable donations greater than $300 ($600 if married filing joint) you must itemize deductions on Schedule A.

Related templates