Donation Form Irs

What is donation form irs?

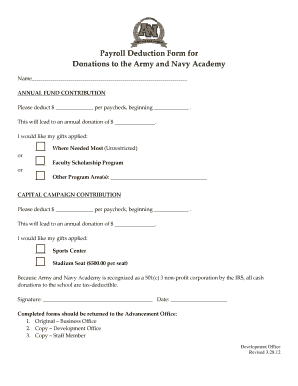

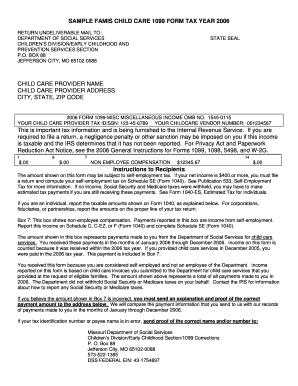

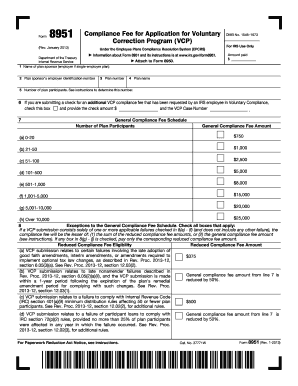

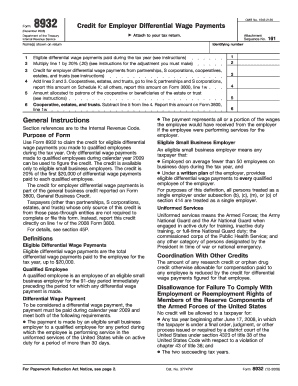

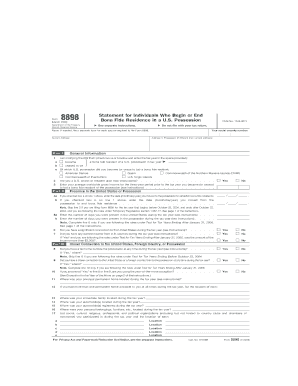

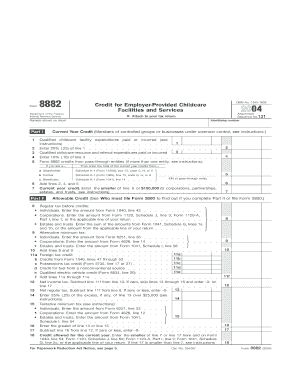

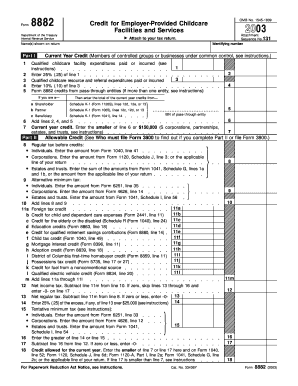

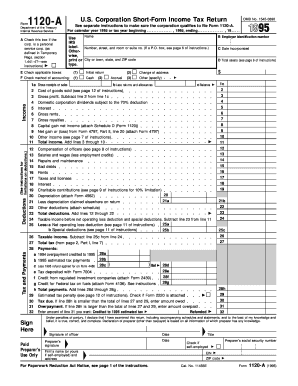

A donation form IRS refers to the specific form used by the Internal Revenue Service (IRS) to report and document charitable donations. It is a crucial document for donors and organizations alike, as it ensures compliance with tax regulations and allows for the proper deduction of charitable contributions.

What are the types of donation form irs?

There are several types of donation forms created by the IRS, each serving a specific purpose. These include: 1. Form 8283: This form is used for non-cash donations exceeding $500 and provides detailed information about the property being donated. 2. Form 8282: This form must be filed by organizations that have received substantial contributions of certain types of property and later dispose of it within three years. 3. Form 1098-C: This form is used to report contributions of motor vehicles, boats, and airplanes. 4. Form 8284: This form is used to claim deductions for the contribution of tangible personal property.

How to complete donation form irs

Completing a donation form IRS requires careful attention to details and accurate information. Here is a step-by-step guide to help you: 1. Obtain the correct form: Identify the specific form that applies to your donation type. 2. Fill in your personal information: Provide your name, address, and taxpayer identification number. 3. Describe the donated property: Provide a detailed description of the donated property, including its value and condition. 4. Attach supporting documents: If required, attach additional documentation to support your donation. 5. Sign and date the form: Don't forget to sign and date the form before submitting it to the IRS. Remember, it's important to consult with a tax professional or refer to IRS guidelines for specific instructions related to your donation form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.