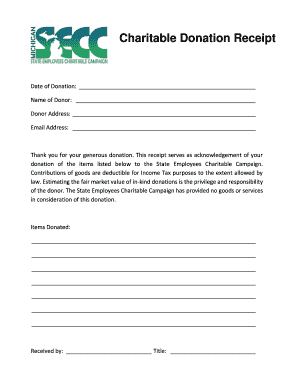

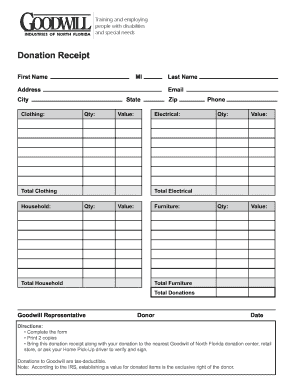

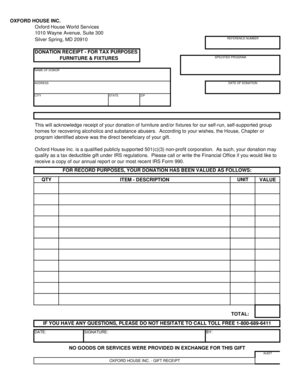

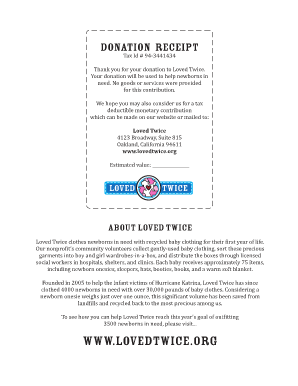

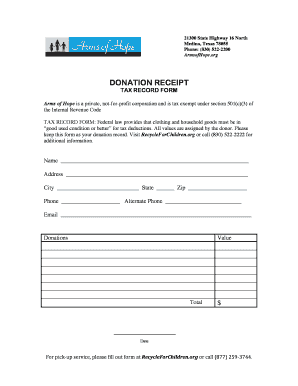

Donation Receipt For Tax Purposes

What is donation receipt for tax purposes?

A donation receipt for tax purposes is a document that acknowledges a charitable contribution made by an individual or organization. It serves as proof of the donation and is necessary for claiming tax deductions.

What are the types of donation receipt for tax purposes?

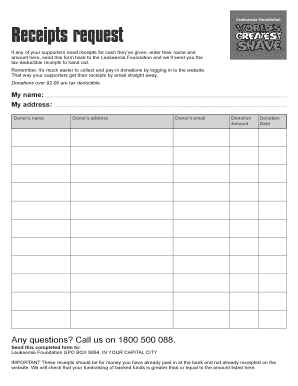

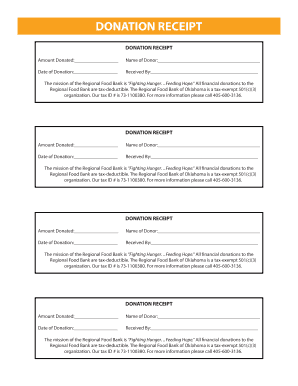

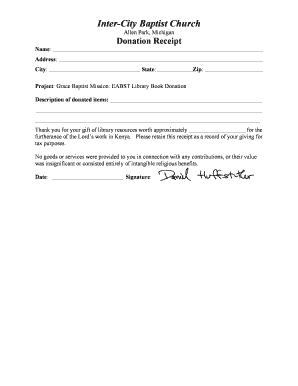

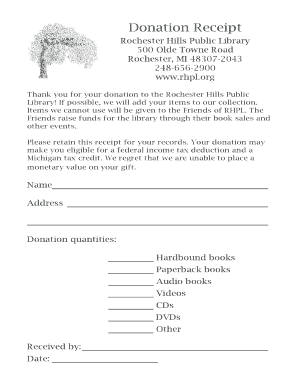

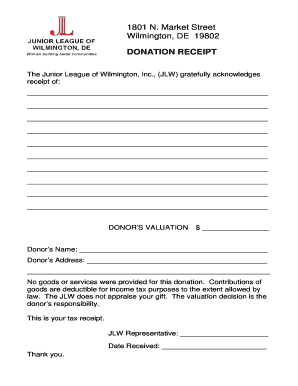

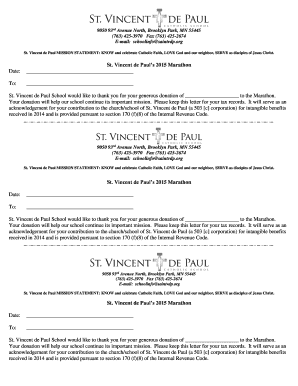

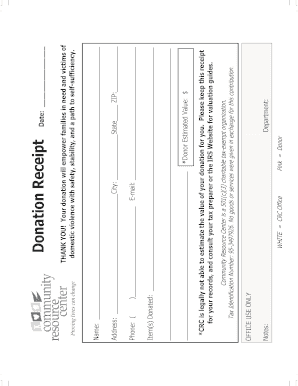

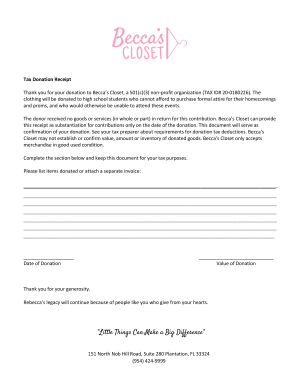

There are two main types of donation receipts for tax purposes: 1. Cash Donation Receipt: This type of receipt is issued when a donor contributes money to a qualified charitable organization. It should include the amount of the donation, the date it was made, and the name and contact information of the organization. 2. Non-Cash Donation Receipt: This receipt is used when a donor donates non-cash items such as clothing, furniture, or vehicles. It should include a description of the donated items, their fair market value, the date of donation, and the name and contact information of the organization.

How to complete donation receipt for tax purposes

Completing a donation receipt for tax purposes requires the following steps: 1. Identify the donor: Include the full name, address, and contact information of the donor. 2. Describe the donation: Provide a detailed description of the donated items or the amount of money donated. 3. State the value: For non-cash donations, determine the fair market value of the items donated. For cash donations, specify the amount donated. 4. Date the receipt: Include the date when the donation was made. 5. Organization details: Include the name, address, and contact information of the charitable organization. 6. Sign and distribute: Sign the receipt and provide a copy to the donor, while keeping a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.