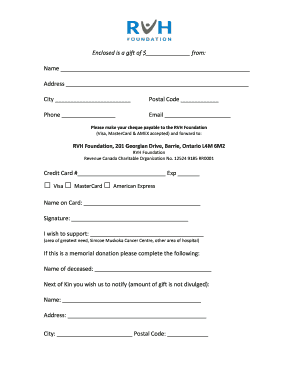

What is Donation Tracker?

Donation Tracker is a powerful tool that allows individuals and organizations to keep track of their donations. It enables users to record and monitor all incoming and outgoing donations, making it easier to manage and analyze their contribution activities. With Donation Tracker, users can gain valuable insights into their donation patterns and make informed decisions about their philanthropic efforts.

What are the types of Donation Tracker?

There are several types of Donation Tracker available to cater to different needs and preferences. Some common types include:

Web-based Donation Tracker: This type of Donation Tracker can be accessed through a web browser, offering the convenience of using it from any device with an internet connection.

Mobile App Donation Tracker: This type of Donation Tracker can be installed on smartphones or tablets, allowing users to manage their donations on the go.

Desktop Software Donation Tracker: This type of Donation Tracker is installed on a computer, offering a comprehensive set of features and customization options.

How to complete Donation Tracker

Completing Donation Tracker is a straightforward process that can be done in a few simple steps:

01

Choose a Donation Tracker that suits your needs and preferences.

02

Set up your account or download the software/app.

03

Enter your personal or organizational details for record-keeping purposes.

04

Start adding donations by specifying the amount, date, and any relevant notes.

05

Categorize your donations based on different criteria such as purpose or donor.

06

Regularly update and maintain your Donation Tracker to ensure accurate and up-to-date information.

07

Utilize the reporting and analytics features to gain insights and optimize your donation activities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.