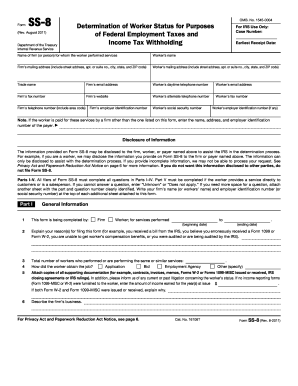

SS-8 Form

Video Tutorial How to Fill Out SS-8 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What paperwork do you need for a 1099 employee?

You'll probably need two documents when tax time rolls around: a W-9 and 1099-NEC. We've included links to the appropriate documents below, but you should also mosey on over to the IRS website to make sure you have the latest versions.

How long does an SS-8 determination take?

After you file Form SS-8, the IRS opens its investigation using the information you and your worker provide. Investigations typically take several months, and you could wait up to six months for your determination.

What is 4137 form used for?

Purpose of form. Use Form 4137 only to figure the social security and Medicare tax owed on tips you didn't report to your employer, including any allocated tips shown on your Form(s) W-2 that you must report as income.

Can you file form SS-8 online?

Where To File. Faxed, photocopied, or electronic versions of Form SS-8 are not acceptable for the initial request for the Form SS-8 determination. Do not submit Form SS-8 with your tax return as that will delay processing time.

Related templates