Escrow Agreement Sample

What is escrow agreement sample?

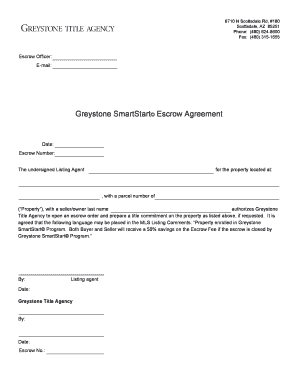

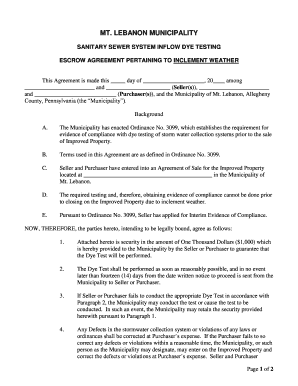

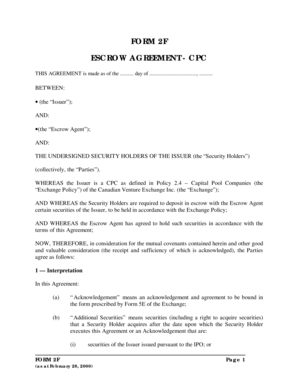

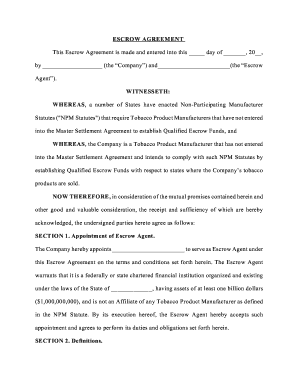

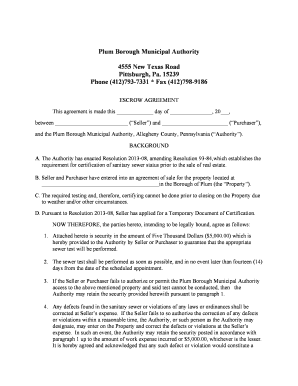

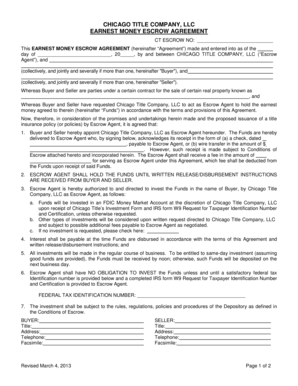

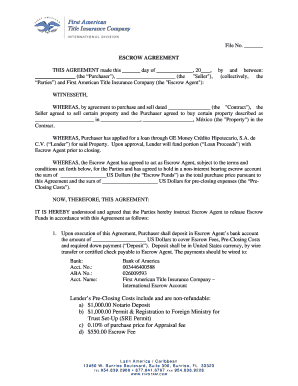

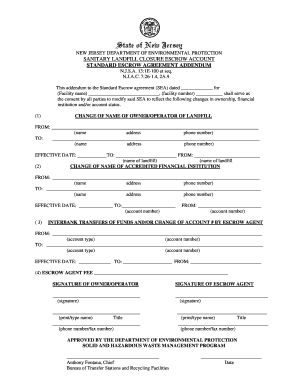

Escrow agreement sample refers to a pre-drafted document that serves as a template for an escrow agreement. This type of agreement is commonly used in various business transactions to ensure the secure transfer of assets or funds. It outlines the terms and conditions, responsibilities, and roles of the parties involved in the escrow process. By using an escrow agreement sample, individuals and businesses can have a clear and legally binding document that protects their interests throughout the escrow arrangement.

What are the types of escrow agreement sample?

There are several types of escrow agreement samples available depending on the specific nature of the transaction. Some common types include: 1. Real estate escrow agreement: This type of escrow agreement is used in real estate transactions such as property sales or lease agreements to secure the buyer's funds until all conditions of the agreement are met. 2. Business escrow agreement: This type of escrow agreement is used when transferring ownership or assets of a business. It ensures that both parties fulfill their obligations and protects the interests of all involved. 3. Online transaction escrow agreement: With the rise of online marketplaces, escrow agreements are becoming more common to facilitate secure transactions between buyers and sellers who may not have a pre-established relationship or trust. These are just a few examples, and the appropriate type of escrow agreement sample will depend on the specific transaction and industry involved.

How to complete escrow agreement sample

Completing an escrow agreement sample involves several essential steps to ensure its effectiveness. Here is a step-by-step guide: 1. Review the escrow agreement sample: Carefully read through the entire agreement, understanding each clause and provision. Make sure it aligns with the specific transaction and addresses all relevant concerns. 2. Customize the agreement: Tailor the escrow agreement sample to your specific needs. Fill in necessary details like names, contact information, transaction specifics, and any additional terms or conditions. 3. Seek legal advice if needed: If you are unsure about any aspect of the escrow agreement or if it involves a complex transaction, it is advisable to consult with a legal professional who specializes in escrow agreements. 4. Review and finalize: Once you have customized the escrow agreement sample and sought legal advice if necessary, review it again to ensure accuracy and completeness. Make any necessary revisions and obtain signatures from all parties involved. By following these steps, you can effectively complete an escrow agreement sample and ensure a smooth and secure transaction.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.