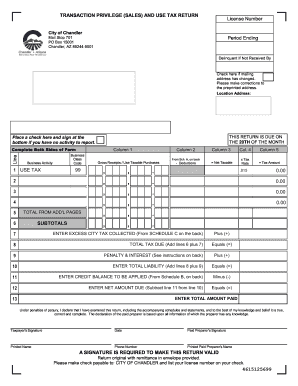

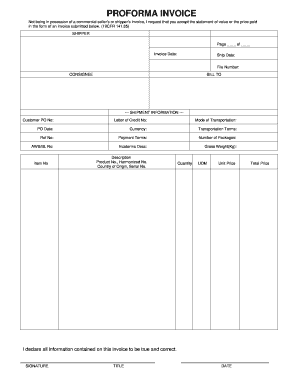

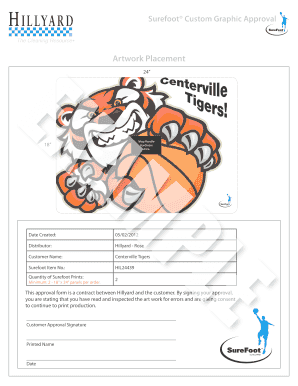

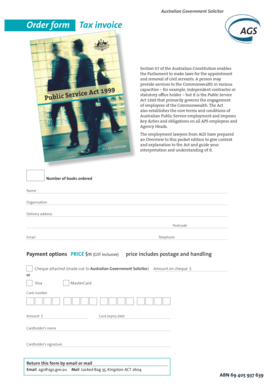

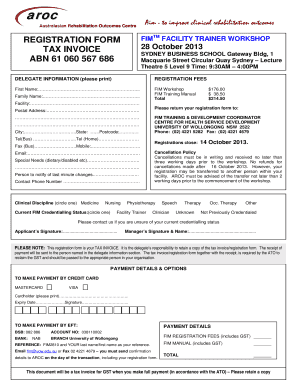

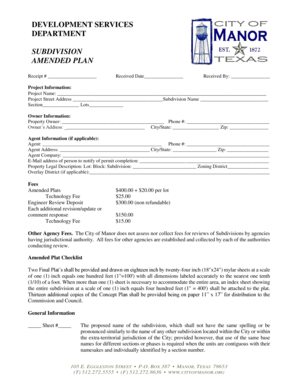

What is an Example of a Tax Invoice?

An example of a tax invoice is a document that is provided by a seller to a buyer to show the details of a sale transaction. It includes important information such as the seller's name and contact information, the buyer's name and contact information, a description and quantity of the items or services sold, the price of each item or service, any applicable taxes, and the total amount due. A tax invoice is used for accounting and taxation purposes and serves as an official record of the sale.

What are the types of Example of a Tax Invoice?

There are several types of tax invoices that can be used depending on the nature of the sale and the applicable tax laws. The most common types include:

Standard Tax Invoice: This is the most basic type of tax invoice and includes all the necessary information mentioned earlier.

Simplified Tax Invoice: This type of tax invoice is used for smaller transactions and is less detailed compared to a standard tax invoice.

Electronic Tax Invoice: As the name suggests, this type of tax invoice is issued electronically and may require electronic signatures or other forms of digital authentication.

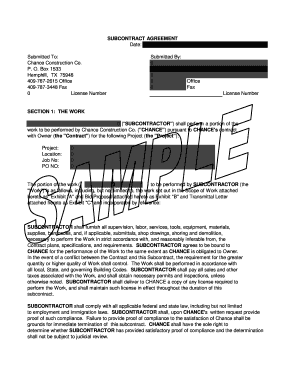

Recurring Tax Invoice: This type of tax invoice is used for regular or recurring transactions, such as monthly subscriptions or service agreements.

Credit Tax Invoice: A credit tax invoice is issued when a refund or credit is given to the buyer due to returned goods, adjustments, or discounts.

Debit Tax Invoice: A debit tax invoice is issued when additional charges or taxes need to be added to the original tax invoice.

How to complete an Example of a Tax Invoice

Completing a tax invoice is a straightforward process. Here is a step-by-step guide:

01

Start by including your business name, address, and contact information at the top of the invoice.

02

Next, provide the buyer's name, address, and contact information.

03

Add a unique invoice number and the invoice date for reference and recordkeeping purposes.

04

List the items or services sold, providing a detailed description, quantity, and price for each.

05

Calculate and include any applicable taxes, such as sales tax or value-added tax, based on the local tax laws.

06

Sum up the total amount due, including the taxes, and clearly state the payment terms and methods accepted.

07

Include any additional information or terms and conditions relevant to the sale.

08

Finally, proofread the invoice for accuracy and completeness before sending it to the buyer.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.