Example Of Bank Reconciliation Statement

What is Example Of Bank Reconciliation Statement?

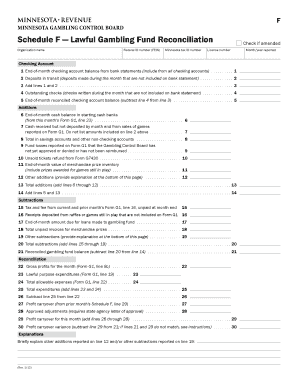

An Example of Bank Reconciliation Statement is a financial document that compares a company's records of its bank transactions with the bank's records. It helps to identify any discrepancies or errors.

What are the types of Example Of Bank Reconciliation Statement?

There are two types of Example of Bank Reconciliation Statement:

Internal Bank Reconciliation Statement: This type of reconciliation statement is prepared by a company's internal accounting department to match its records with the bank's records.

External Bank Reconciliation Statement: This type of reconciliation statement is prepared by an external auditor or accountant to verify the accuracy of a company's bank transactions.

How to complete Example Of Bank Reconciliation Statement

To complete an Example of Bank Reconciliation Statement, follow these steps:

01

Gather all relevant bank statements and financial records.

02

Compare the company's records with the bank's records and identify any discrepancies.

03

Investigate and resolve any discrepancies or errors.

04

Update the company's records to reflect the accurate bank transactions.

05

Prepare the reconciliation statement showing the adjustments made.

06

Verify the final reconciliation statement for accuracy.

07

File the reconciliation statement for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Example Of Bank Reconciliation Statement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does Excel have a bank reconciliation template?

This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. Use this bank reconciliation example template to help rectify any errors in your financial statement. This is an accessible template.

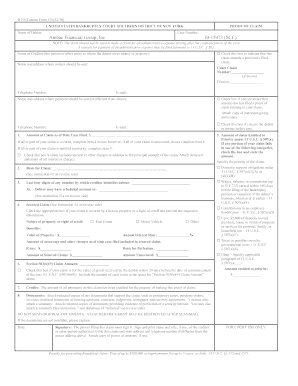

What is bank reconciliation statement format?

A bank reconciliation statement is a document that compares the cash balance on a company's balance sheet to the corresponding amount on its bank statement. Reconciling the two accounts helps identify whether accounting changes are needed.

How do you format a bank reconciliation statement?

Bank Reconciliation Procedure On the bank statement, compare the company's list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit. Using the cash balance shown on the bank statement, add back any deposits in transit. Deduct any outstanding checks.

What are the 4 steps in the bank reconciliation?

The four steps in the bank reconciliation process is as follows: Compare the deposits. Adjust the bank statements. Adjust the cash account. Compare the balances.

How do I prepare a bank reconciliation statement in Excel?

Below is step by step procedure for Bank Reconciliation: Match the Opening balance as per Bank statement with the books. Check and tick all the debit entries as reflected in bank ledger with the credit entries in Bank Statement, identify which are missed.

What 3 items do you need to reconcile your bank statement?

There are three steps: comparing your statements, adjusting your balances, and recording the reconciliation. Step one: Comparing your statements. Step two: Adjusting your balances. Step three: Recording the reconciliation.

Related templates