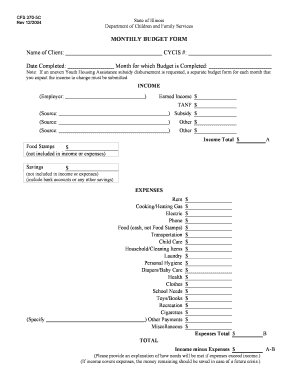

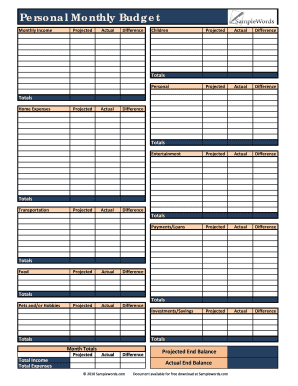

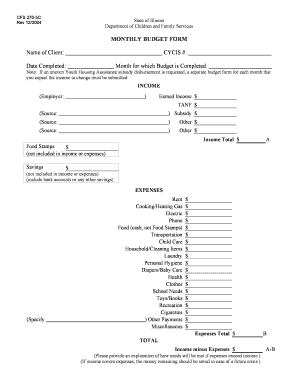

Family Monthly Budget Template

What is Family Monthly Budget Template?

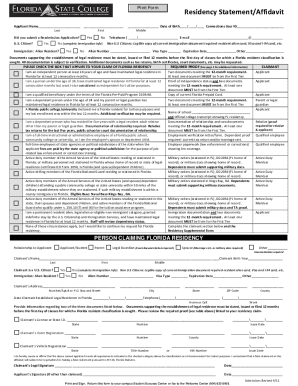

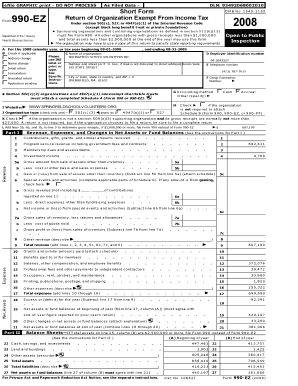

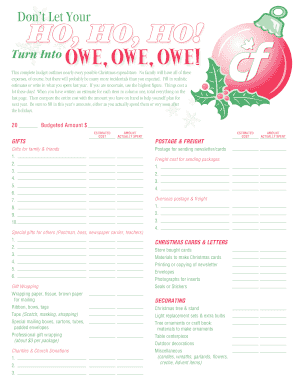

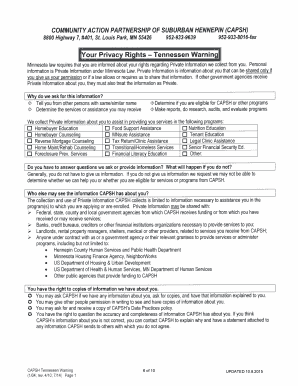

A Family Monthly Budget Template is a pre-designed document that helps families to track and manage their monthly expenses and income. It provides a structured format to allocate funds for various categories such as groceries, utilities, rent, transportation, and savings. By using this template, families can gain a better understanding of their financial situation, identify areas where they can reduce expenses, and set financial goals.

What are the types of Family Monthly Budget Template?

Family Monthly Budget Templates come in various formats to cater to different preferences and needs. Some common types of Family Monthly Budget Templates include:

How to complete Family Monthly Budget Template

Completing a Family Monthly Budget Template is a simple process that requires the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.