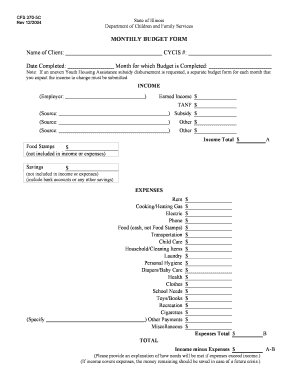

Family Monthly Budget Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you structure a monthly budget?

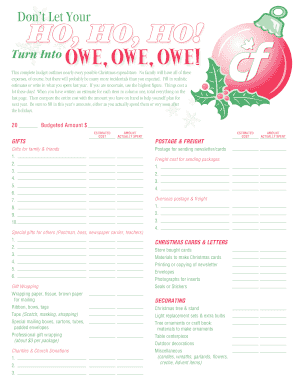

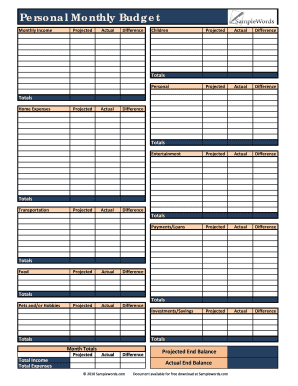

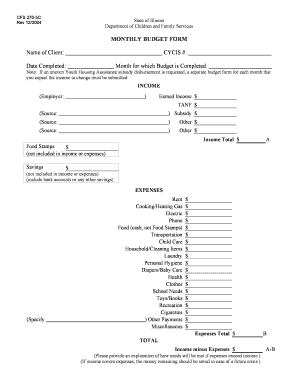

Create a Personal Budget: How to Make a Budget Gather your financial statement. Record all sources of income. Create a list of monthly expenses. Fixed Expenses. Variable Expenses. Total your monthly income and monthly expenses. Budget Spreadsheet Example. Set a goal.

What should a monthly budget look like?

Setting budget percentages That rule suggests you should spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings and paying off debt. While this may work for some, it's often better to start with a more detailed categorizing of expenses to get a better handle on your spending.

What's the 50 30 20 budget rule?

The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

Which budget rule is best?

Try a simple budgeting plan. We recommend the popular 50/30/20 budget to maximize your money. In it, you spend roughly 50% of your after-tax dollars on necessities, no more than 30% on wants, and at least 20% on savings and debt repayment. We like the simplicity of this plan.

How do I create a monthly budget?

How to make a monthly budget: 5 steps Calculate your monthly income. The first step when building a monthly budget is to determine how much money you make each month. Spend a month or two tracking your spending. Think about your financial priorities. Design your budget. Track your spending and refine your budget as needed.

What are essentials in the 50 30 20 rule?

The 50/30/20 rule budget is a simple way to budget that doesn't involve detailed budgeting categories. Instead, you spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings or paying off debt.

Related templates