Fbar Form

What is Fbar Form?

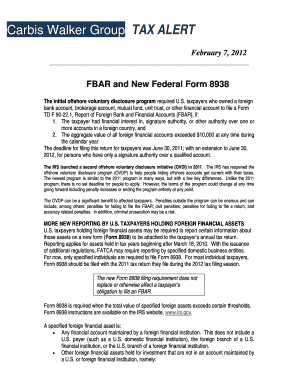

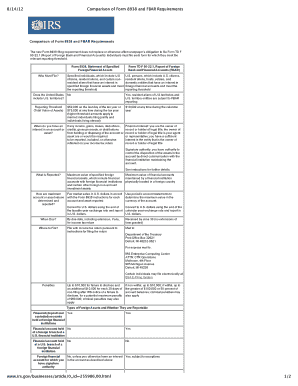

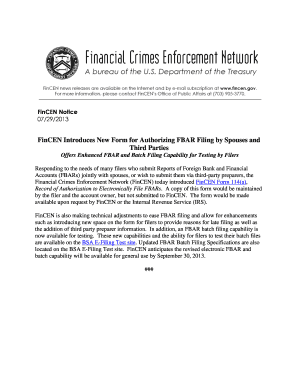

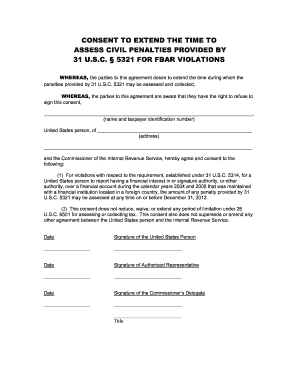

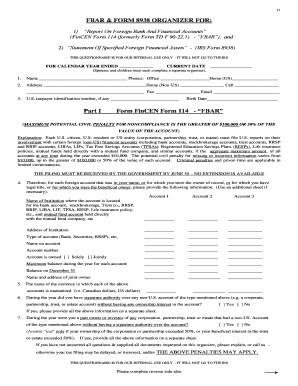

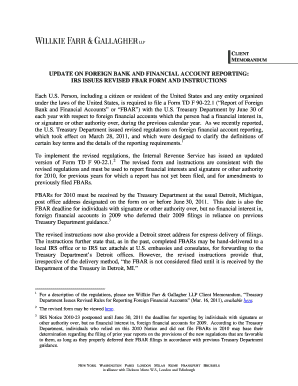

Fbar Form, also known as Form FinCEN 114, is a document required by the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) for reporting foreign financial accounts held by U.S. taxpayers. It is used to collect information about these accounts to combat tax evasion and other financial crimes.

What are the types of Fbar Form?

There is only one type of Fbar Form, which is the FinCEN 114 form. This form is used to report foreign financial accounts exceeding certain thresholds as mandated by the IRS. It is essential for taxpayers to accurately complete this form and report their foreign accounts as required by law.

How to complete Fbar Form

Completing the Fbar Form may seem daunting, but with the right guidance, it can be a straightforward process. Here are the steps to complete the Fbar Form:

By utilizing online platforms like pdfFiller, you can simplify the process of completing the Fbar Form. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.