Financial Plan Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the most important step in financial planning?

While setting goals is a key part of the financial planning process, implementing your plan and working to meet those goals may be the most important step.

What are the 7 steps of financial planning?

7 Steps of Financial Planning Define your short- and long-term goals. Audit your current income, savings, and long-term savings and investing plan. Address shortfalls/adjust goals. Account for multiple future scenarios. Develop a comprehensive financial plan. Implement and monitor that plan.

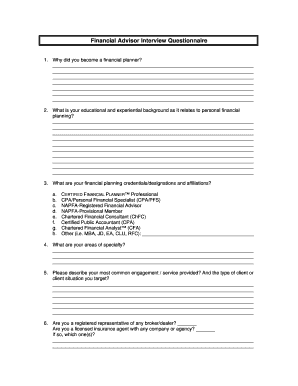

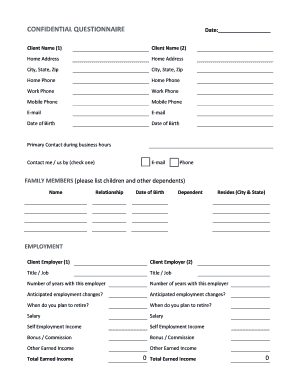

How do you write a financial plan for a client?

The 7 Steps of Financial Planning. Step 1: Understanding the Circumstances. Step 2: Identifying and Selecting Goals. Step 3: Analyzing the Client's Situation. Step 4: Develop the Plan. Step 5: Presenting the Recommendations. Step 6: Implementing Recommendation(s) Step 6: Monitor the Plan.

What are the steps of financial planning?

Financial Planning Process 1) Identify your Financial Situation. 2) Determine Financial Goals. 3) Identify Alternatives for Investment. 4) Evaluate Alternatives. 5) Put Together a Financial Plan and Implement. 6) Review, Re-evaluate and Monitor The Plan.

How do you write a financial plan?

How to write a business financial plan Calculate set-up costs. Forecast profit and loss. Work out your cash-flow projections. Forecast balance sheet. Find your break-even point. Look for professional help.

What are the 5 components of a financial plan?

8 Components of a Good Financial Plan Financial goals. Net worth statement. Budget and cash flow planning. Debt management plan. Retirement plan. Emergency funds. Insurance coverage. Estate plan.

Related templates