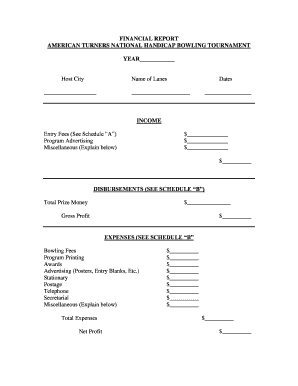

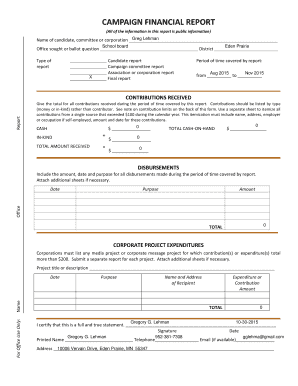

Financial Report

What is Financial Report?

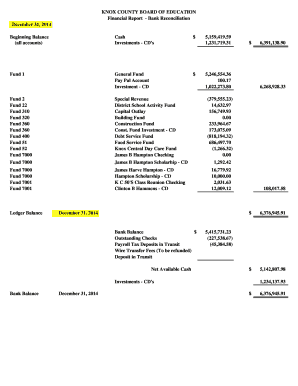

A financial report is a document that provides an overview of an individual or organization's financial activities. It includes information about income, expenses, assets, liabilities, and equity. Financial reports are essential for assessing the financial health and performance of an entity.

What are the types of Financial Report?

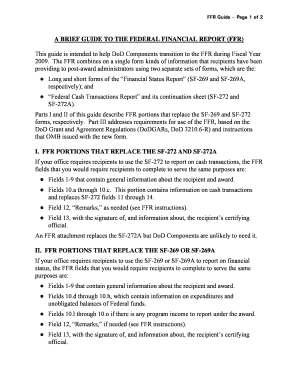

There are several types of financial reports, each serving a specific purpose: 1. Income Statement: Also known as a profit and loss statement, it shows the revenues, expenses, and net income or loss over a specific period. 2. Balance Sheet: It provides a snapshot of an entity's financial position by summarizing its assets, liabilities, and equity at a given point in time. 3. Cash Flow Statement: This report shows the inflow and outflow of cash during a particular period, highlighting the sources and uses of funds. 4. Statement of Shareholders' Equity: It details the changes in equity, including capital contributions, net income, and dividends. 5. Financial Highlights: This report presents a concise summary of an entity's financial data, focusing on key metrics and highlights.

How to complete Financial Report

Completing a financial report requires careful attention to detail and adherence to accounting principles. Here's a step-by-step guide to help you: 1. Gather Financial Data: Collect all relevant financial information, such as income and expense records, bank statements, and supporting documents. 2. Choose a Reporting Period: Determine the time frame for which the financial report will cover, such as monthly, quarterly, or annually. 3. Organize the Information: Sort and categorize the data into the appropriate financial statement sections, such as income, expenses, assets, and liabilities. 4. Prepare the Statements: Use accounting software or templates to create the income statement, balance sheet, cash flow statement, and shareholders' equity statement. 5. Review for Accuracy: Double-check all calculations and ensure the data accurately reflects the financial activities. 6. Analyze and Interpret: Evaluate the financial statements to assess the entity's performance, identify trends, and make informed decisions. 7. Share and Communicate: Present the financial report to relevant stakeholders, such as management, investors, or regulatory bodies.

pdfFiller offers a powerful solution for creating, editing, and sharing financial reports online. With unlimited fillable templates and advanced editing tools, pdfFiller streamlines the process, making it the ideal PDF editor to get your documents done efficiently.