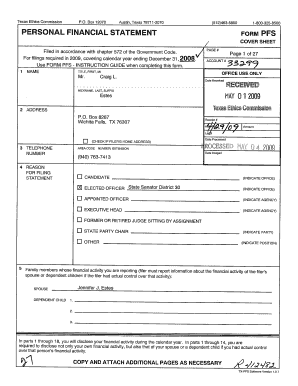

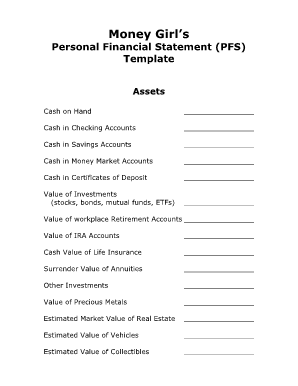

What is Financial Statement Template?

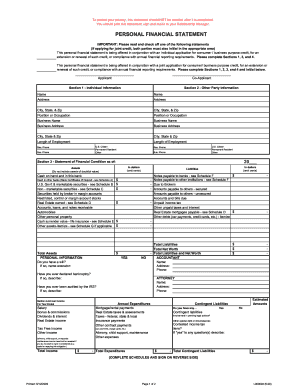

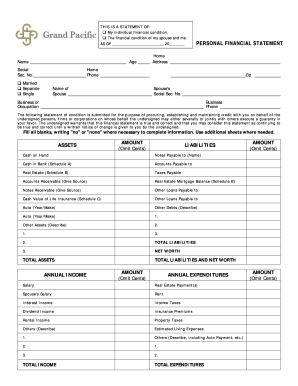

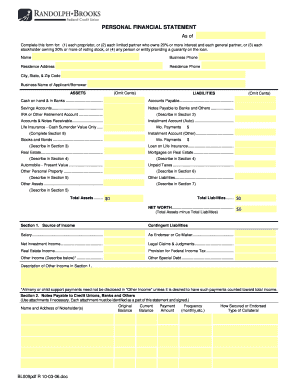

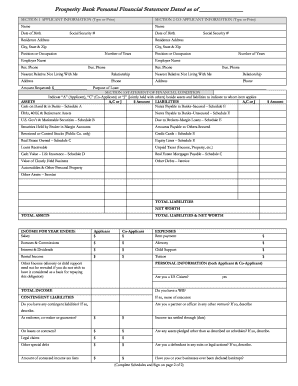

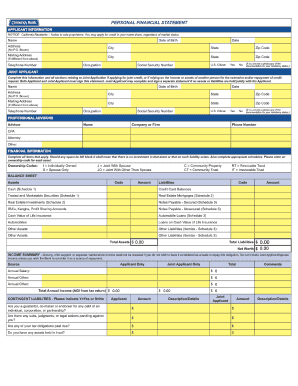

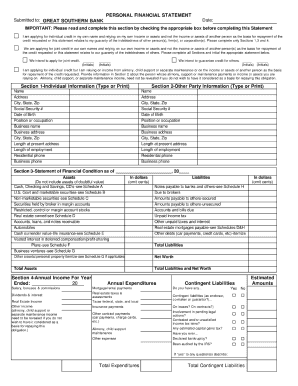

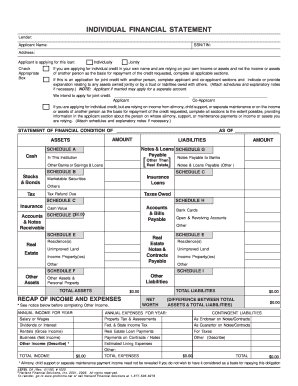

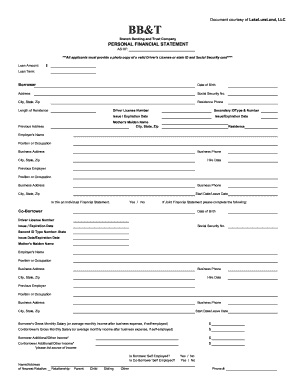

A financial statement template is a pre-designed document that helps individuals and businesses organize and present their financial information. It includes sections for recording income, expenses, assets, liabilities, and other financial data. By using a financial statement template, users can efficiently create accurate and professional-looking reports to analyze their financial health.

What are the types of Financial Statement Template?

There are several types of financial statement templates available to cater to different needs. Some common types include:

Income Statement Template: This template focuses on the revenue, expenses, and net income of a business.

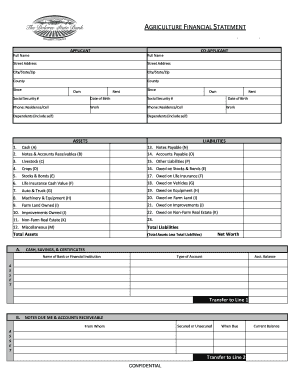

Balance Sheet Template: This template provides a snapshot of a company's financial position by outlining its assets, liabilities, and equity.

Cash Flow Statement Template: This template tracks the inflow and outflow of cash within a specific period, highlighting the liquidity of a business.

Profit and Loss Statement Template: Also known as an income statement, this template summarizes a company's revenue, expenses, and profits over a specific period.

Budget Template: This template helps individuals and businesses plan and track their income and expenses to ensure financial stability.

Financial Ratio Analysis Template: This template allows users to calculate and analyze various financial ratios to assess a company's performance and financial health.

How to complete Financial Statement Template

Completing a financial statement template can seem daunting, but with the right approach, it becomes a manageable task. Here are the steps to complete a financial statement template:

01

Gather all necessary financial information, including bank statements, invoices, receipts, and other relevant documents.

02

Input the information accurately into the designated sections of the template, making sure to categorize income, expenses, assets, and liabilities properly.

03

Double-check all calculations to ensure accuracy.

04

Review and analyze the completed financial statement to gain insights into your financial situation.

05

Make any necessary adjustments or corrections.

06

Save and share the completed financial statement with relevant parties, such as investors, lenders, or business partners.

With pdfFiller, the entire process of creating, editing, and sharing financial statements becomes even more streamlined. As a comprehensive PDF editor, pdfFiller empowers users to easily fill out financial statement templates online, eliminating the need for manual paperwork. Its powerful editing tools enable users to make professional-looking modifications, while the ability to save and share documents securely enhances collaboration and efficiency. Whether you're an individual or a business, pdfFiller is the ideal solution for all your financial statement needs.