What is Fixed Asset Record With Depreciation?

Fixed Asset Record With Depreciation is a financial document that tracks and records the value of a company's fixed assets over time while accounting for depreciation. Depreciation is the gradual decrease in value of an asset due to wear and tear, obsolescence, or other factors. This record allows businesses to better understand the current value of their fixed assets and plan for future upgrades or replacements.

What are the types of Fixed Asset Record With Depreciation?

There are several types of Fixed Asset Record With Depreciation that businesses can choose from, depending on their specific needs and accounting methods. Some common types include:

Straight-Line Method: This method evenly allocates the depreciation expense over the useful life of the asset.

Declining Balance Method: This method allocates higher depreciation expenses in the early years and lower expenses in later years.

Units of Production Method: This method calculates depreciation based on the asset's usage or production output.

Sum-of-the-Years'-Digits Method: This method accelerates depreciation expenses, allocating more depreciation in the early years and less in later years.

Double-Declining Balance Method: This method provides higher depreciation expenses in the early years and minimizes depreciation in later years.

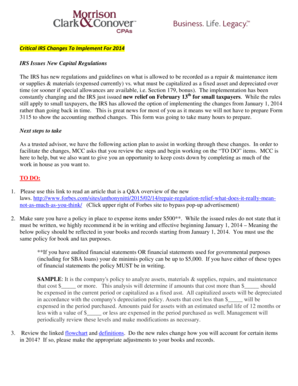

How to complete Fixed Asset Record With Depreciation

Completing a Fixed Asset Record With Depreciation involves the following steps:

01

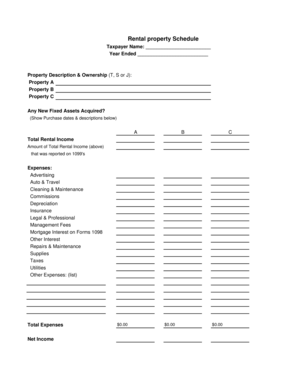

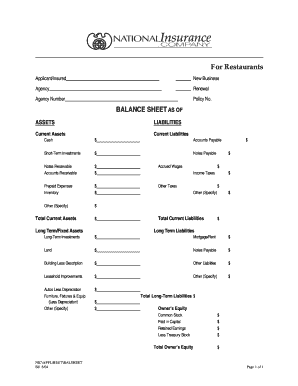

Gather all necessary information about the fixed assets, including their purchase date, cost, useful life, and estimated salvage value.

02

Choose the appropriate depreciation method based on your business's accounting policies and regulatory requirements.

03

Calculate the depreciation expense for each asset using the chosen depreciation method.

04

Record the depreciation expense in your financial records, ensuring the accuracy and consistency of the information.

05

Regularly update and reconcile the Fixed Asset Record With Depreciation to reflect any additions, disposals, or changes in asset values.

06

Review the Fixed Asset Record With Depreciation periodically to assess the financial health of your company and make informed decisions regarding asset management.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.