What is a Forbearance Agreement?

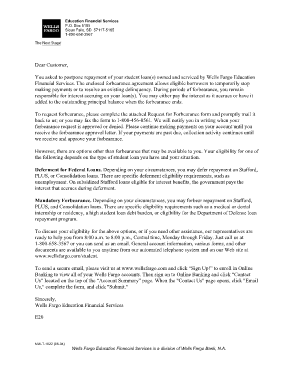

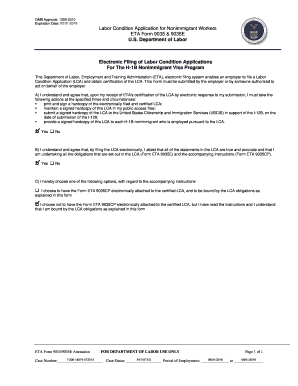

A Forbearance Agreement is a legal contract between a borrower and a lender. It is usually entered into when the borrower is facing financial difficulties and is unable to make their loan payments on time. The agreement allows the borrower to temporarily pause or reduce their loan payments, giving them some relief and time to get back on track financially.

What are the types of Forbearance Agreement?

There are several types of Forbearance Agreements that borrowers and lenders can consider, depending on their specific circumstances. Some common types include:

General Forbearance: This type of agreement is applicable to various types of debt, such as mortgage loans, student loans, or credit card debt. It provides a temporary suspension or reduction of payments for a specific period of time.

COVID-19 Forbearance: With the ongoing pandemic situation, many lenders have introduced special forbearance agreements to assist borrowers who are affected financially by COVID-These agreements often include extended payment periods or reduced interest rates.

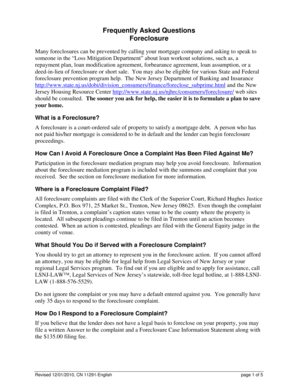

Mortgage Forbearance: This type of forbearance agreement is specifically tailored for mortgage loans. It allows homeowners to temporarily suspend or reduce their mortgage payments until they can get back on their feet financially.

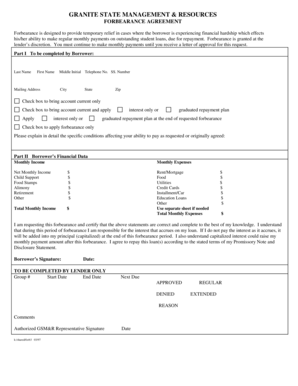

How to complete a Forbearance Agreement

Completing a Forbearance Agreement may seem daunting, but it can be a relatively straightforward process if you follow these steps:

01

Understand your financial situation and the reasons for seeking forbearance. Assess your ability to resume regular payments in the future.

02

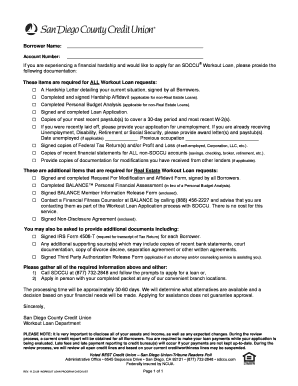

Contact your lender and inform them about your financial difficulties. They will provide you with the necessary forms and guidance to start the forbearance process.

03

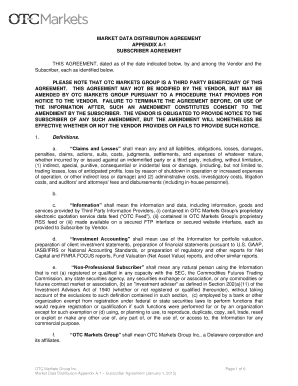

Carefully review the terms and conditions of the forbearance agreement. Make sure you understand the repayment plan, any interest accrual, and the duration of the forbearance period.

04

Fill out the required forms accurately and provide any supporting documentation requested by your lender. Double-check all the information before submitting to avoid delays.

05

Submit the completed forms and documentation to your lender as instructed. Keep a copy of everything for your records.

With pdfFiller, completing and managing a Forbearance Agreement becomes even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.