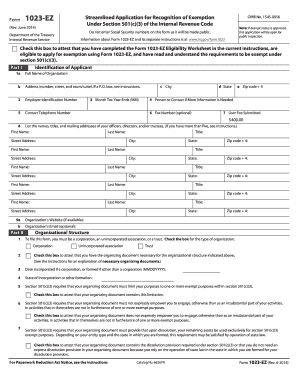

Form 1023-ez Eligibility Worksheet

What is form 1023-ez eligibility worksheet?

The form 1023-ez eligibility worksheet is a document used by organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. It helps determine if an organization is eligible to use the streamlined Form 1023-EZ instead of the more complex Form 1023.

What are the types of form 1023-ez eligibility worksheet?

There are three types of form 1023-ez eligibility worksheets:

Initial Eligibility Worksheet - This worksheet is for organizations that have never applied for tax-exempt status before.

Reinstatement Eligibility Worksheet - This worksheet is for organizations whose tax-exempt status has been automatically revoked and are seeking reinstatement.

Streamlined Retroactive Eligibility Worksheet - This worksheet is for organizations that want to apply for retroactive tax-exempt status using the streamlined process.

How to complete form 1023-ez eligibility worksheet

To complete form 1023-ez eligibility worksheet, follow these steps:

01

Download the appropriate eligibility worksheet based on your organization's situation.

02

Fill in the required information, such as organization name, address, and employer identification number (EIN).

03

Answer the eligibility questions accurately and provide any necessary supporting documentation.

04

Review the completed worksheet for any errors or missing information.

05

Submit the form along with your application for tax-exempt status.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What happens if I use Form 1023 EZ and bring in more than $50000?

In the event that you exceed the $50,000 threshold, the IRS can retroactively revoke your organization's 501(c)(3) status if you are unable to make a persuasive case that you met the Form 1023-EZ eligibility criteria at the time you applied.

How much does it cost to file a 1023 EZ?

How much is the user fee for an exemption application? The user fee for Form 1023 is $600. The user fee for Form 1023-EZ is $275. The user fees must be paid through Pay.gov when the application is filed.

What happens if I use Form 1023 EZ and bring in more than $50 000?

In the event that you exceed the $50,000 threshold, the IRS can retroactively revoke your organization's 501(c)(3) status if you are unable to make a persuasive case that you met the Form 1023-EZ eligibility criteria at the time you applied.

Can you file 1023 EZ online?

To file Form 1023-EZ, you must first create an account at www.pay.gov. Once you have registered with Pay.gov, you will be able to create and save a draft of the Form 1023-EZ which you may then submit electronically through the Pay.gov website after paying the user fee.

How long does it take for Form 1023 EZ to be approved?

As the name suggests, Form 1023-EZ is easier to complete, and the rate of approval is very high, but there may be disadvantages to using this form. The average processing time for Form 1023-EZ is about 2-4 weeks. By contrast, Form 1023 can take between 3 and 6 months for processing, and it could take up to a year.

How long does it take to get a 501c3 determination letter?

It may take 60 days or longer to process your request. You may also request an affirmation letter using Form 4506-B.

Related templates