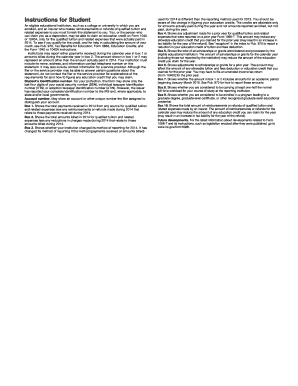

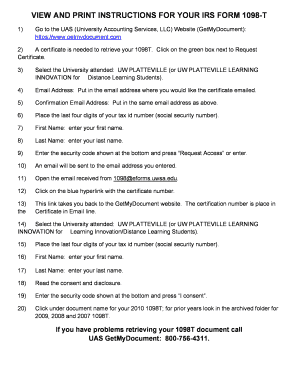

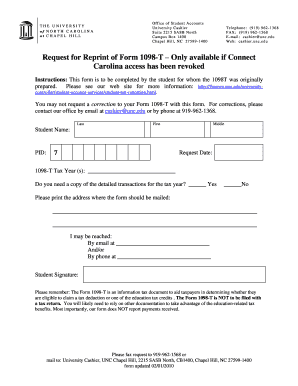

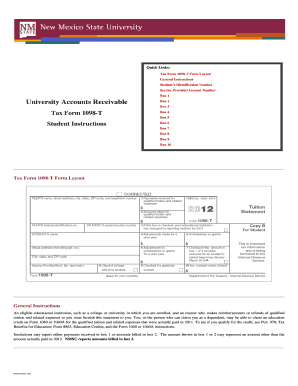

Form 1098-t Instructions

Video Tutorial How to Fill Out form 1098-t instructions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

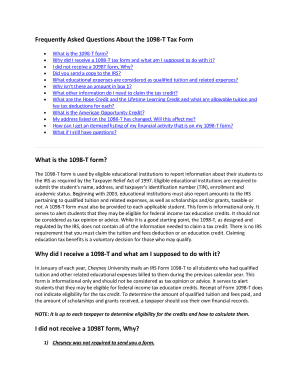

How do I fill out a 1098-T form?

1:02 2:10 Learn How to Fill the Form 1098-T Tuition Statement - YouTube YouTube Start of suggested clip End of suggested clip Include tuition for the following semester in the next tax year indicate. So in box 7. Indicate. IfMoreInclude tuition for the following semester in the next tax year indicate. So in box 7. Indicate. If the student is a graduate student in box 8.

Who files 1098-T parent or student?

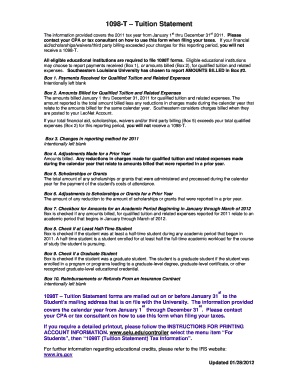

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

What do I do if I receive a 1098-T?

What should I do with my 1098-T? When you're ready to file your federal income tax return, make sure you have your Form 1098-T on hand — if you received one. It can help you calculate two potentially valuable education credits — the American opportunity tax credit and the lifetime learning credit.

Who files the 1098-T student or parent?

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

How does a 1098-T affect my taxes?

The Form 1098-T is a form provided to you and the IRS by an eligible educational institution that reports, among other things, amounts paid for qualified tuition and related expenses. The form may be useful in calculating the amount of the allowable education tax credits.

Who puts the 1098-T on their taxes?

With a 1098-T, the business — your college — reports how much qualified tuition and expenses you (or your parents) paid it during the tax year. The IRS uses these forms to match data from information returns to income, deductions and credits reported on individual income tax returns.

Related templates