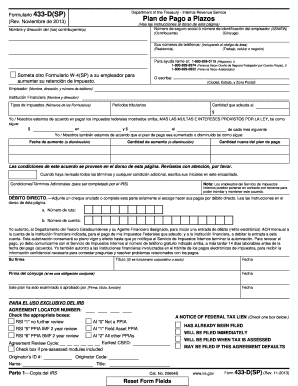

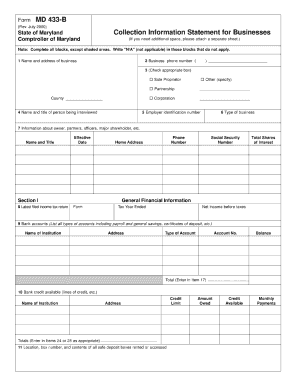

Form 433-a

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between 433-A and 433-F?

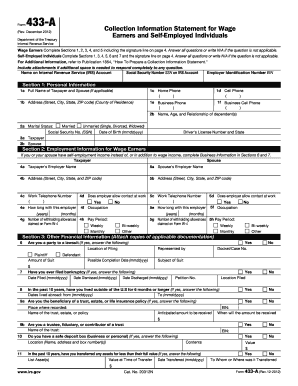

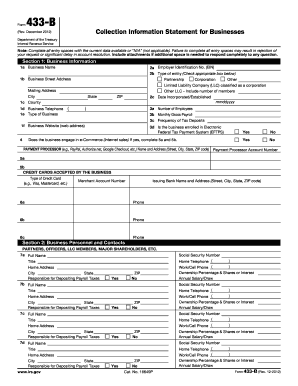

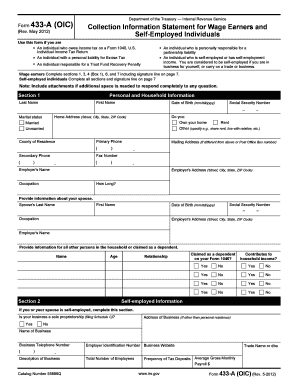

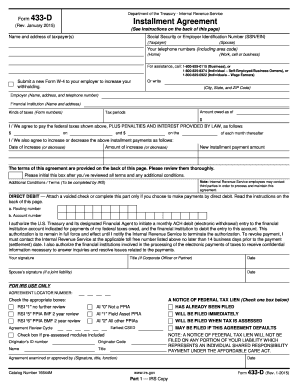

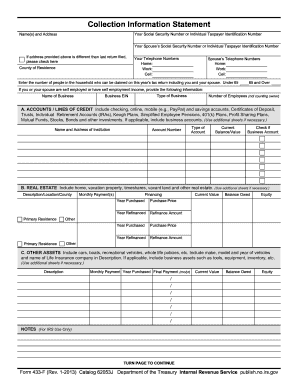

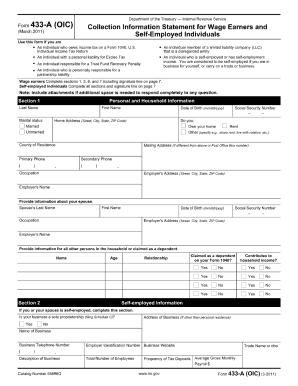

The Differences Between Forms 433-A, B, and F Form 433-A and 433-B are both six pages long, but Form 433-F is only two pages long. Form 433-A or 433-B (business) is generally requested by IRS revenue officers, whereby IRS collections require 433-F. Form 433-F is much easier to complete.

Do I qualify for an IRS offer in compromise?

You're eligible to apply for an Offer in Compromise if you: Filed all required tax returns and made all required estimated payments. Aren't in an open bankruptcy proceeding. Have a valid extension for a current year return (if applying for the current year)

How do you fill out a 433 A?

1:20 27:49 How to fill out IRS Form 433-A OIC - 2022 - YouTube YouTube Start of suggested clip End of suggested clip You have to fill this out okay employer's name pay period so like how often are you paid what's yourMoreYou have to fill this out okay employer's name pay period so like how often are you paid what's your employer's. Address you got to fill all this out.

What is the difference between Form 433-A and 433-A OIC?

Types of Form 433-A Form 433-A is the long form of the Collection Information Statement. Form 433-A OIC is the version of the form specifically used when seeking an offer in compromise.

How do I fill out form 433-A?

1:20 27:49 How to fill out IRS Form 433-A OIC - 2022 - YouTube YouTube Start of suggested clip End of suggested clip You have to fill this out okay employer's name pay period so like how often are you paid what's yourMoreYou have to fill this out okay employer's name pay period so like how often are you paid what's your employer's. Address you got to fill all this out.

What is Form 433-F used for?

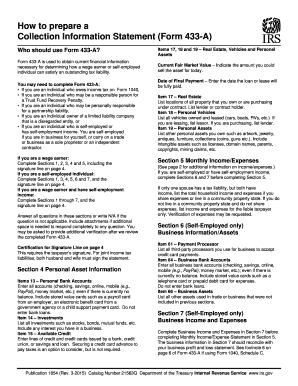

What is the purpose of Form 433F? Form 433-F is used to obtain current financial information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability. Note: You may be able to establish an Online Payment Agreement on the IRS web site.

Related templates