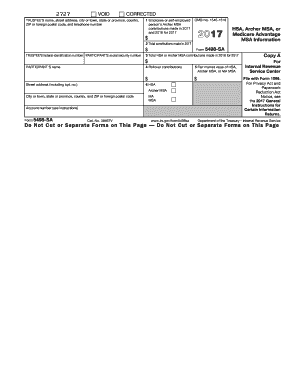

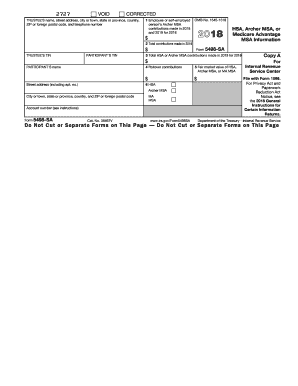

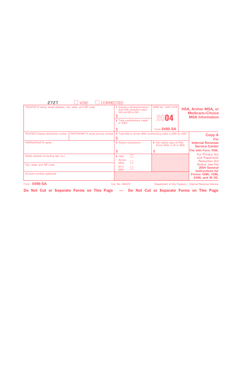

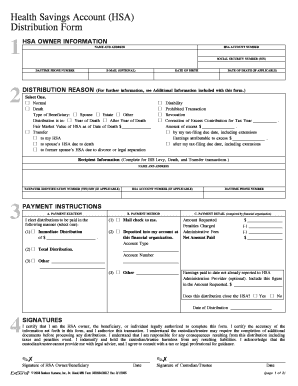

Form 5498-sa

Video Tutorial How to Fill Out form 5498-sa

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I get my 5498-SA online?

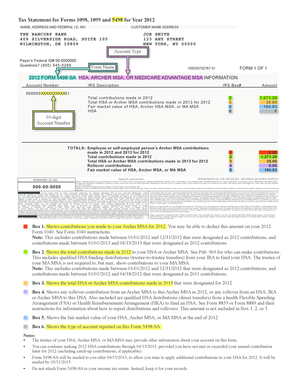

You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically (based upon your elected delivery preference). These IRS tax forms are also available in the Member Website.

Do I have to enter form 5498-SA on my tax return?

Do I Have to (Or Should I) Report My HSA Contributions? Form 5498-SA is not required in order to file a tax return.

Will I get a 5498-SA every year?

IRS Form 5498-SA is typically available around the end of January. If you contribute in the new year for the previous tax year, you will also get another 5498-SA form in May.

Who provides the 5498-SA form?

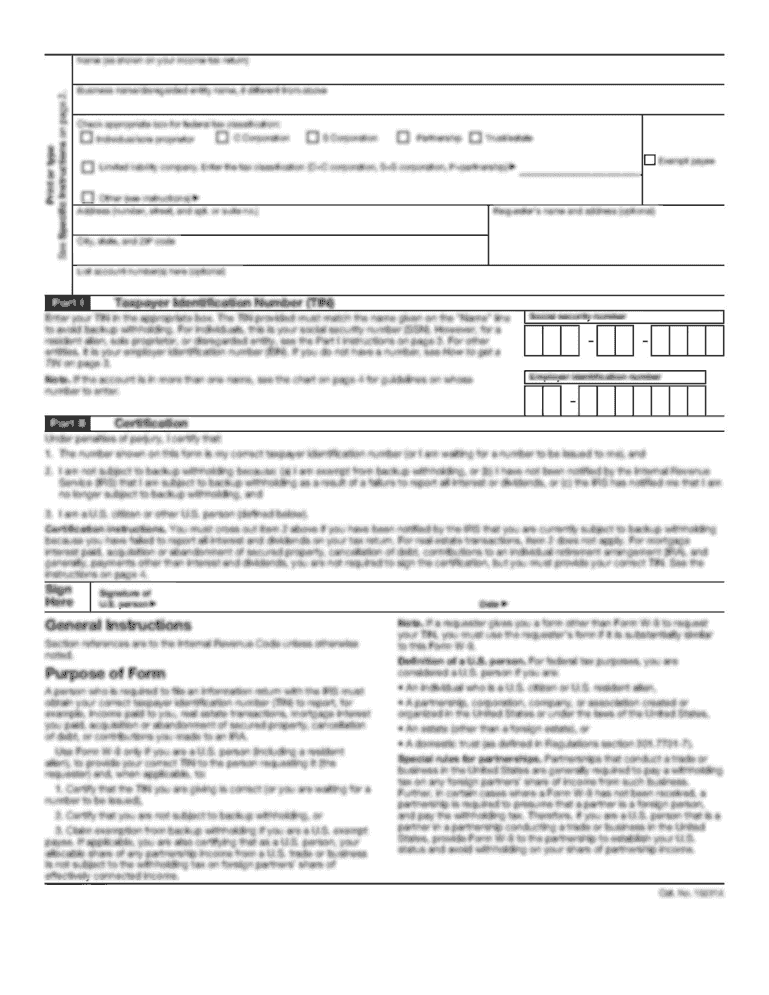

Form 5498-SA is available to trustees online via the IRS website and can be filed electronically.

How do I get a copy of my form 5498-SA?

Go to www.irs.gov, where you can download Instructions for Forms 8889, 1099-SA, 8853, and 5498-SA. IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans. and IRS Publication 502, Medical and Dental Expenses (Including the Health Coverage Tax Credit).

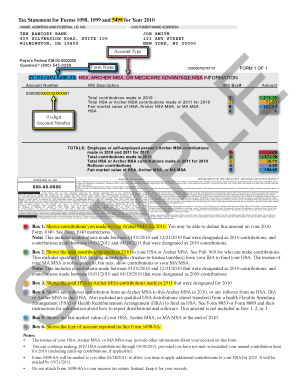

How do I report 5498-SA on my taxes?

Note: Do not attach Form 5498-SA to your income tax return. Instead, keep it for your records. Generally, contributions you make to your Fidelity HSA are made on a pretax basis via payroll deduction and are not deductible. Any contributions you make on an after-tax basis—via check, for example—are tax deductible.

Related templates