Form 8283 Example

What is form 8283 example?

Form 8283 example is a document used by taxpayers to report noncash charitable contributions. It helps individuals determine the fair market value of their donated property for tax purposes. By providing detailed information about the property being donated and its estimated value, taxpayers can claim deductions on their tax returns.

What are the types of form 8283 example?

There are two types of form 8283 example depending on the value and type of noncash contributions:

Form 8283 example for contributions valued at $500 or less.

Form 8283 example for contributions valued at more than $500.

How to complete form 8283 example

To complete form 8283 example, follow these steps:

01

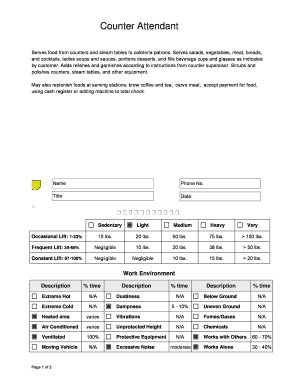

Provide your personal information including name, address, and taxpayer identification number (TIN).

02

Describe the donated property in detail, including its type, quantity, condition, and any restrictions on its use.

03

Determine the fair market value of the donated property and provide supporting documentation.

04

Indicate if you received any goods, services, or benefits in exchange for the contribution.

05

Certify the accuracy of the information provided and sign the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out form 8283 example

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

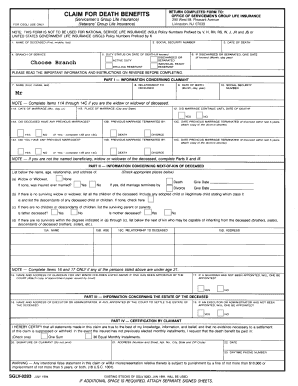

How do I report a stock donation?

When you file your federal taxes, you must report your stock donation on IRS Form 8283, which is the form for non-cash charitable contributions. You'll file this form with your tax return for the year you donated the stock.

How do I use form 8283?

You must complete Form 8283 and attach it to the return if the total deduction for all noncash contributions is more than $500. If the taxpayer is claiming a deduction for a contribution of noncash property worth $5,000 or less, you must complete Section A of Form 8283.

How do I fill out a 8283 car donation?

Completing Form 8283 Write the name and address of the organization you donated to in column (a) for lines A through E. If the item you donated is a vehicle, check the top box in column (b) and write the vehicle identification number (VIN) in the second line of boxes in this column.

What is the form 8283?

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

Where do I put charitable contributions on 1065?

Click the three dots at the top of the screen and select Lines 12-19. Scroll down to the Other Deductions (13) section. Locate the Charitable Contributions (8) subsection. Enter the contributions in the appropriate fields under Cash or Noncash.

Can form 8283 be filed electronically?

Generally, you can either print out Form 8283 and mail a paper copy to the IRS or file it electronically.

Related templates