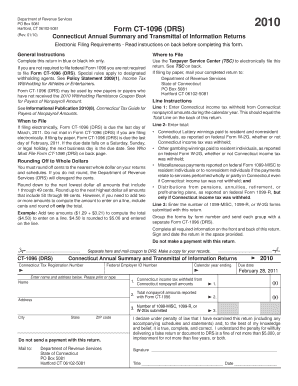

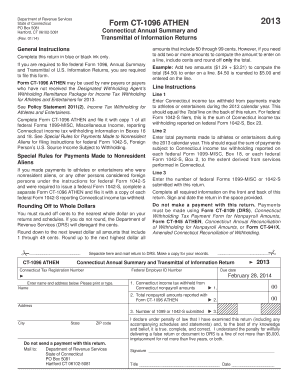

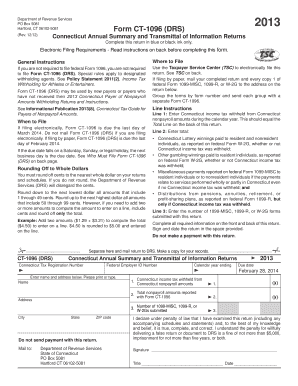

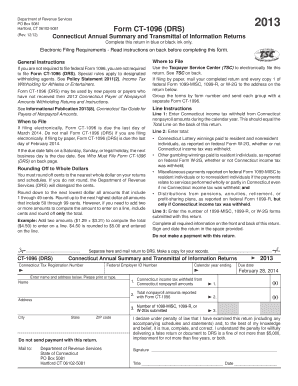

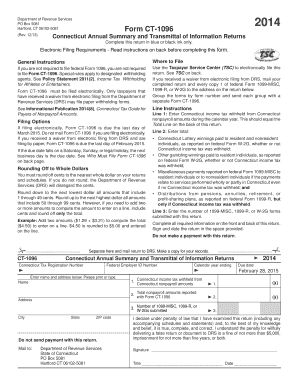

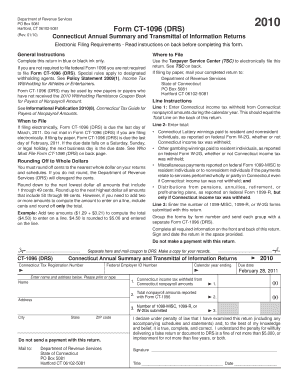

Form Ct-1096

What is Form Ct-1096?

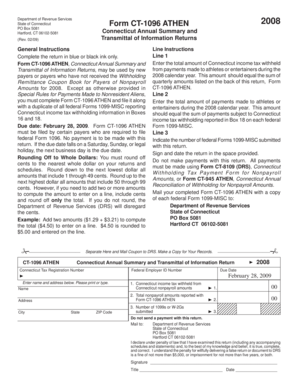

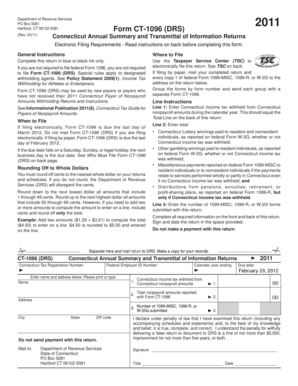

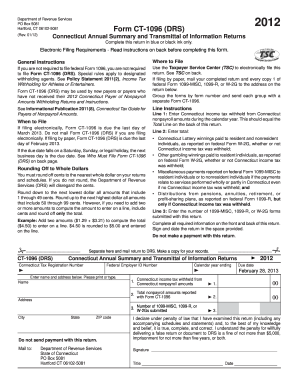

Form Ct-1096 is a tax document issued by the state of Connecticut to report income tax withheld from payments made to non-residents. This form is used by employers and other entities to report state income tax withholding on certain kinds of income paid to Connecticut residents.

What are the types of Form Ct-1096?

There are two main types of Form Ct-1096:

Form Ct-1096 (- This is the most recent version of the form, updated for the 2019 tax year.

Form Ct-1096 (- This is the updated version of the form for the 2020 tax year.

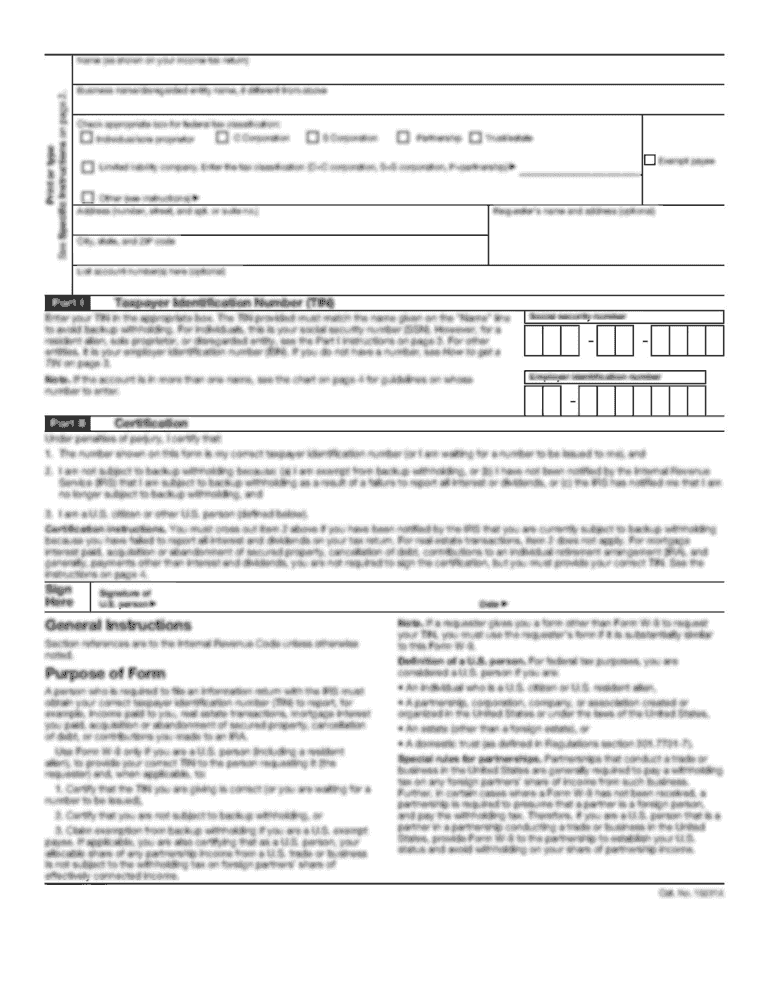

How to complete Form Ct-1096

Completing Form Ct-1096 is a straightforward process. Follow these steps:

01

Gather all necessary information, including income tax withheld and recipient information.

02

Fill in the required fields accurately and completely.

03

Double-check all information for accuracy and completeness before submitting the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form Ct-1096

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Will IRS accept printed 1096?

The official printed version of this IRS form is scannable, but a copy, printed from this website, is not. Do not print and file a Form 1096 downloaded from this website. a penalty may be imposed for filing with the IRS information return forms that can't be scanned.

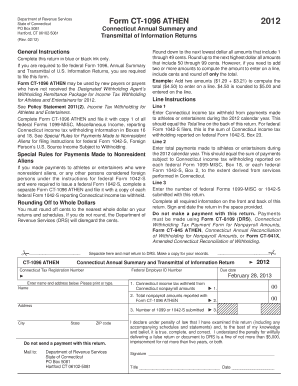

How do I file a CT 1096 online?

Taxpayers that are not able to log into myconneCT and need to submit Form 1099-MISC/CT-1096 may do so on-line by using myconneCT. Visit the myconneCT Welcome Page and select File 1099-MISC/CT-1096 hyperlink from the panel. Choose how you would like to submit your 1099-Misc data.

How do I prepare a 1096 form?

Form 1096 instructions Step 1: Complete your business's information returns. Step 2: Fill in the basic information at the top of IRS Form 1096. Step 3: Complete box 1 or 2, plus box 3. Step 4: Complete box 4 and 5. Step 5: Complete box 6 and 7. Step 6: Review Form 1096 and file with the IRS. File electronically.

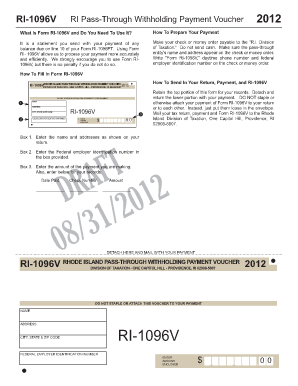

Do you have to file a 1096 if you file electronically?

Keep in mind IRS Form 1096 is only necessary for the mail transmittal of U.S. information returns. if you plan to go the e-file route and file your information returns electronically, you don't need to worry about attaching Form 1096.

Can Form 1096 be filled out by hand?

Upload complete! A: Yes, it is permissible to submit handwritten forms.

What is the deadline for 1096 forms to be mailed 2022?

The filing deadline for Form 1096 depends on the filing deadline of the form it accompanies. The filing deadline is the same whether you file by mail or online. For tax year 2022, With Forms 1099-NEC, file by January 31, 2023.

Related templates