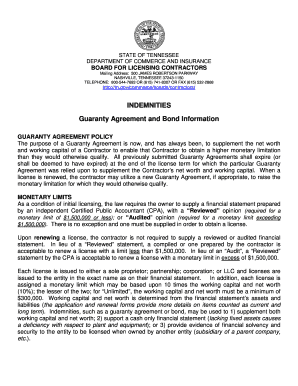

What is a guaranty agreement sample?

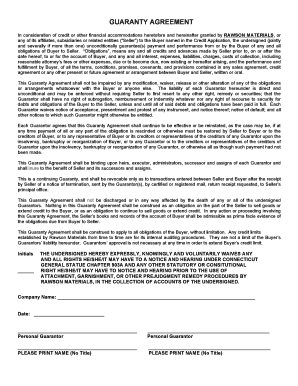

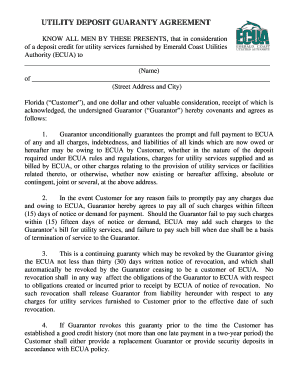

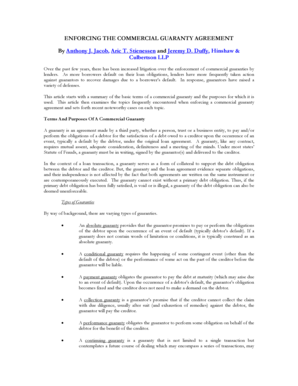

A guaranty agreement sample is a legal document that outlines the terms and conditions of a guarantee provided by one party (the guarantor) to another party (the creditor or lender). This document serves as a written promise to pay a debt or fulfill an obligation if the debtor or borrower fails to do so. It provides security to the creditor by ensuring that they have a recourse to recover their money or enforce the terms of the agreement.

What are the types of guaranty agreement sample?

There are several types of guaranty agreement samples that cater to different situations and requirements. Some common types include:

Payment Guaranty Agreement: This type of agreement ensures the payment of a loan or debt by the guarantor if the borrower defaults.

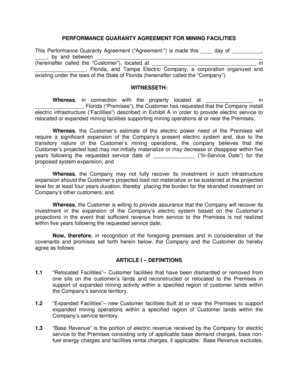

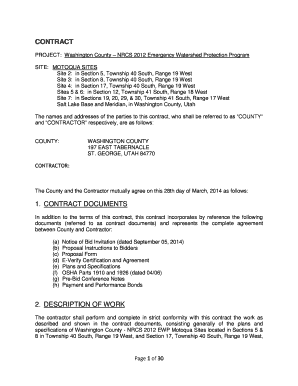

Performance Guaranty Agreement: This agreement guarantees the performance of a specific obligation, such as the completion of a project or delivery of goods or services.

Financial Guaranty Agreement: This type of agreement involves the guarantor guaranteeing the financial obligations of another entity, often used in the finance industry.

Lease Guaranty Agreement: A lease guaranty agreement guarantees the payment of rent and other lease obligations by the guarantor if the lessee fails to fulfill their obligations.

How to complete a guaranty agreement sample?

Completing a guaranty agreement sample can be done in a few simple steps:

01

Include the names and contact information of the parties involved - the guarantor, the creditor, and the debtor.

02

Clearly define the obligations or debts covered by the guaranty agreement.

03

Specify the conditions under which the guarantor's liability is triggered, such as default or non-payment by the debtor.

04

Outline the rights and remedies available to the creditor in case of the guarantor's default.

05

Include any additional clauses or provisions as required by the specific situation.

06

Ensure that all parties involved carefully review and understand the terms of the agreement before signing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.