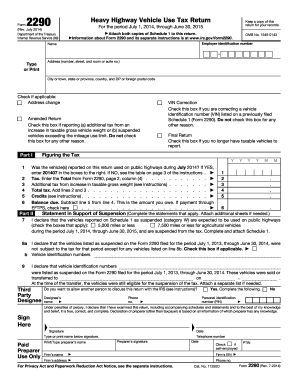

Heavy Highway Vehicle Use Tax Return Form - Page 2

What is Heavy Highway Vehicle Use Tax Return Form?

The Heavy Highway Vehicle Use Tax Return Form, also known as Form 2290, is a federal tax form used by owners and operators of heavy vehicles to report and pay the annual tax on vehicles with a gross weight of 55,000 pounds or more. This tax is imposed to fund and maintain the country's highway system.

What are the types of Heavy Highway Vehicle Use Tax Return Form?

There are two types of Heavy Highway Vehicle Use Tax Return Forms: 1. Form 2290: This is the standard form used for most vehicles with a gross weight of 55,000 pounds or more. It is filed annually and the payment is due by August 31st. 2. Form 2290-V: This is the payment voucher that accompanies Form 2290 when paying the tax due. It should be sent along with the payment to the designated IRS address.

How to complete Heavy Highway Vehicle Use Tax Return Form

Completing the Heavy Highway Vehicle Use Tax Return Form is a simple process that can be done in a few steps: 1. Gather the required information, including your employer identification number (EIN), vehicle identification number (VIN), and the gross weight of each vehicle. 2. Fill out the necessary details on Form 2290, such as your name, address, and vehicle details. 3. Calculate the tax amount based on the weight category of each vehicle. 4. Double-check all the information provided and make sure it is accurate. 5. Sign and date the form. 6. Attach the payment voucher (Form 2290-V) and the payment for the tax due, if applicable. 7. Mail the form to the designated IRS address. It is important to file the form and make the payment by the due date to avoid any penalties or interest charges.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.