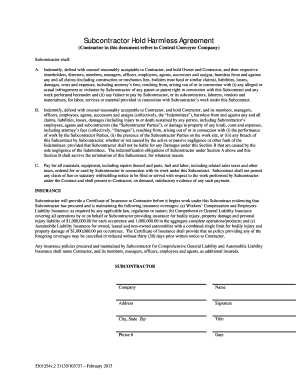

Hold Harmless And Insurance Agreement - Page 2

What is Hold Harmless And Insurance Agreement?

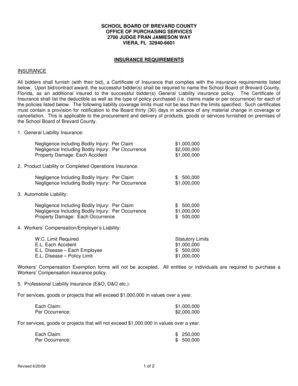

A Hold Harmless and Insurance Agreement, also known as an indemnity agreement, is a legally binding contract between two parties in which one party agrees to assume the liability and responsibility for any potential claims, damages, or losses that may arise from the other party's actions, behaviors, or participation in certain activities. This agreement is designed to protect the party assuming the liability from any legal or financial consequences that may arise as a result of the other party's activities.

What are the types of Hold Harmless And Insurance Agreement?

There are different types of Hold Harmless and Insurance Agreements that can be used depending on the specific circumstances and relationships between the parties involved. Some common types include: 1. General Hold Harmless Agreement: This type of agreement typically applies to situations where one party assumes the liability for any claims or damages arising out of the other party's actions or inactions. 2. Specific Hold Harmless Agreement: In this type of agreement, the liability is limited to a specific activity, event, or situation. 3. Mutual Hold Harmless Agreement: This agreement is used when both parties agree to mutually release each other from any liability or claims that may arise from their respective actions.

How to complete Hold Harmless And Insurance Agreement?

Completing a Hold Harmless and Insurance Agreement involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.