Home Budget Calculator - Page 2

What is Home Budget Calculator?

A Home Budget Calculator is a tool that helps individuals or families manage their finances by tracking income and expenses. It allows you to organize your financial information and provides a clear picture of where your money is going.

What are the types of Home Budget Calculator?

There are several types of Home Budget Calculators available, each with its own features to cater to different needs. Some popular types include:

Basic Home Budget Calculator: This type provides a simple way to track income and expenses.

Advanced Home Budget Calculator: This type offers more advanced features such as budget forecasting and goal setting.

Mobile Home Budget App: These are smartphone apps that allow you to track your budget on the go.

Online Home Budget Tools: These web-based tools provide the convenience of accessing your budget from anywhere with an internet connection.

How to complete Home Budget Calculator

Completing a Home Budget Calculator is easy and straightforward. Here are the steps to follow:

01

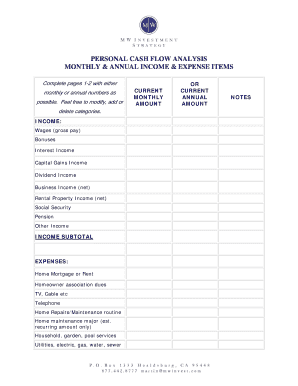

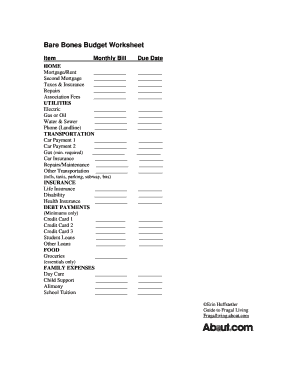

Gather your financial information: Collect all your income and expense details, including bills, pay stubs, bank statements, and receipts.

02

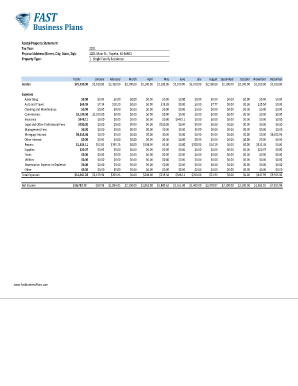

Categorize your income and expenses: Create categories to organize your income and expenses. This can include categories like income, housing, transportation, groceries, entertainment, etc.

03

Enter the information: Input the collected data into the Home Budget Calculator. Fill in the appropriate fields with the corresponding amounts.

04

Analyze the results: Once you have entered all the information, the Home Budget Calculator will calculate your total income, expenses, and savings. Review the results to gain insights into your financial situation.

05

Make adjustments: If needed, make changes to your budget by adjusting your expenses or finding ways to increase your income.

06

Track your progress: Continually update and monitor your Home Budget Calculator to keep track of your finances and stay on top of your budget goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 70 20 10 Rule money?

The 70-20-10 Rule For example, if you spend 75% of your income on living expenses, reduce the amount you put into your savings by 5%. If you want to put more money into your savings, you must reduce your living expenses and/or decrease your debt.

What are essentials in the 50 30 20 rule?

The 50/30/20 rule budget is a simple way to budget that doesn't involve detailed budgeting categories. Instead, you spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings or paying off debt.

What is the 70 10 rule?

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

Which budget rule is best?

Try a simple budgeting plan. We recommend the popular 50/30/20 budget to maximize your money. In it, you spend roughly 50% of your after-tax dollars on necessities, no more than 30% on wants, and at least 20% on savings and debt repayment. We like the simplicity of this plan.

How do you do the 70 20 10 rule?

How the 70/20/10 Budget Rule Works. Following the 70/20/10 rule of budgeting, you separate your take-home pay into three buckets based on a specific percentage. Seventy percent of your income will go to monthly bills and everyday spending, 20% goes to saving and investing and 10% goes to debt repayment or donation.

What is the 50 20 30 budget rule?

Key Takeaways. The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

Related templates