What is Home Budget Planner?

Home Budget Planner is a tool that helps individuals or families track and manage their finances. It allows users to create a comprehensive budget by recording their income, expenses, and savings goals. With a Home Budget Planner, you can easily keep track of your financial health and make informed decisions about your spending and saving habits.

What are the types of Home Budget Planner?

There are various types of Home Budget Planners available to suit different needs and preferences. Some popular types include:

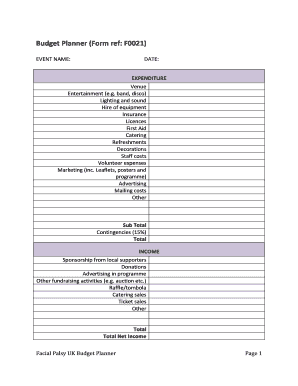

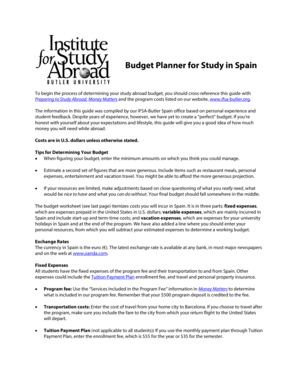

Spreadsheet-based Home Budget Planner: This type of budget planner is created using spreadsheet software like Microsoft Excel or Google Sheets. It allows users to customize their budget categories and enter their income and expenses manually.

Online Home Budget Planner: This type of budget planner is accessible through online platforms or mobile apps. It offers features like automatic transaction syncing, budget goal tracking, and expense categorization.

Mobile Apps: There are numerous mobile apps specifically designed for budget planning. These apps often come with additional features like expense tracking, bill reminders, and financial insights.

Printable Home Budget Planner: This type of budget planner is in the form of printable templates that can be filled out manually. It provides a convenient option for those who prefer a tangible budget planner.

How to complete Home Budget Planner

Completing a Home Budget Planner is a simple and straightforward process. Here are the steps to follow:

01

Gather your financial documents: Collect all your bank statements, bills, pay stubs, and any other relevant financial documents.

02

Set financial goals: Determine your short-term and long-term financial goals, such as saving for a vacation or paying off debt.

03

Track your income: Record all sources of income, including salaries, freelance earnings, and any other additional income streams.

04

List your expenses: Categorize your expenses into fixed (mortgage/rent, utilities) and variable (groceries, entertainment) categories. Track your expenses for a month to get an accurate picture of your spending habits.

05

Create a budget: Based on your income and expenses, create a budget that allocates funds for different categories and aligns with your financial goals.

06

Review and adjust: Regularly review your budget to identify areas where you can cut back or save more. Make adjustments as needed to stay on track.

07

Use a budgeting tool: Consider using a Home Budget Planner tool like pdfFiller to streamline the budgeting process and make it more efficient.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.